Huang Criticizes US Export Controls, Commends Trump Administration

Table of Contents

Huang's Key Criticisms of US Export Controls

Huang's critique focuses on the perceived unfairness and damaging impact of specific US export controls on [Specific Industry/Sector affected, e.g., semiconductor manufacturing, telecommunications]. His arguments center on several key points:

-

Disproportionate Impact: Huang likely argues that these controls disproportionately harm [Specific companies or nations, e.g., Chinese semiconductor manufacturers, Huawei], hindering their technological advancement and economic growth. This impact ripples through the entire supply chain, affecting not only major players like [Specific companies mentioned, e.g., SMIC, TSMC] but also smaller, supporting businesses. The resulting economic slowdown can have far-reaching consequences.

-

Violation of Fair Trade Principles: The argument could be made that these export controls violate established international trade principles, creating an uneven playing field and potentially provoking retaliatory measures from affected nations. This could be linked to specific WTO agreements or other international trade laws, raising questions of legality and fairness in global commerce.

-

Stifling Innovation: Huang's argument likely emphasizes how the restrictions stifle innovation by limiting access to crucial technologies and impeding collaborative research and development. This includes the restriction of access to vital components, advanced software, and critical intellectual property, hindering the progress of affected industries.

-

National Security Concerns vs. Economic Realities: The criticism likely explores the delicate balance between legitimate national security concerns and the harsh economic realities for businesses and countries impacted by the controls. Finding a path that addresses both security needs and economic stability is a major challenge highlighted by this debate.

Specific Export Controls Targeted by Huang

Huang's criticism likely targets specific regulations, including:

-

Entity List Restrictions: The inclusion of specific companies or individuals on the Entity List, severely restricting their access to US technology and components, effectively isolating them from the global technology ecosystem. This is a powerful tool, but its use raises concerns about its impact on innovation and fair trade.

-

Foreign Direct Product Rule (FDPR): The complexity and expansive reach of the FDPR, which regulates the use of US technology even in foreign-made products, significantly complicates global supply chains and increases compliance burdens. This has far-reaching consequences for multinational corporations.

-

Technology Transfer Restrictions: Regulations governing the transfer of sensitive technologies potentially stifle collaboration and knowledge sharing, hindering the development of cutting-edge technologies and slowing global technological advancement. This affects both academic research and private sector development.

Unexpected Commendation of the Trump Administration's Approach

Despite his sharp criticisms of specific export controls, Huang's statement may include a surprising commendation of certain aspects of the Trump administration's approach:

-

Clarity and Predictability (to a degree): While undeniably strict, the Trump administration’s approach may have offered a degree of clarity and predictability in terms of regulations, reducing uncertainty compared to potentially more ambiguous approaches under other administrations. This aspect, while seemingly minor, can be crucial for businesses planning long-term strategies.

-

Targeted Approach (arguably): The argument could be made that, while impactful, the Trump administration's approach was more targeted than some alternatives, focusing on specific technologies and entities considered high-risk. This targeted approach, while controversial, might have minimized collateral damage to some degree.

-

Emphasis on Domestic Production: The Trump administration's "America First" policy, while controversial internationally, may have inadvertently stimulated domestic investment and production in key technology sectors. Huang might view this as a positive long-term economic outcome for the US, even if it came at the expense of international collaboration.

Conclusion: Navigating the Complexities of US Export Controls

Huang's critique provides a vital perspective on the intricacies of US export controls, underscoring the urgent need for a more balanced approach that carefully weighs national security imperatives against economic realities. The unexpected praise for certain aspects of the Trump administration's approach reveals a nuanced understanding of the inherent challenges. Future strategies concerning export controls must strive for greater clarity, predictability, and a more equitable consideration of economic factors alongside national security objectives. Understanding Huang's arguments is paramount for all stakeholders involved in international trade and the global technological landscape. To gain a deeper understanding of the ramifications of Huang's statements and their impact on global trade, further research into [relevant research papers/publications/reports] is strongly recommended. Join the ongoing conversation by exploring further analysis on "Huang Criticizes US Export Controls."

Featured Posts

-

Gospodin Savrseni Vanja I Sime Fotografije I Reakcije Publike

May 22, 2025

Gospodin Savrseni Vanja I Sime Fotografije I Reakcije Publike

May 22, 2025 -

Blockbusters A Bgt Special Event Review

May 22, 2025

Blockbusters A Bgt Special Event Review

May 22, 2025 -

Bbc Breakfast Guests Unexpected Live Broadcast Interruption

May 22, 2025

Bbc Breakfast Guests Unexpected Live Broadcast Interruption

May 22, 2025 -

Rediscovering A Classic Dennis Quaid Meg Ryan And James Caan In A Neglected Western Neo Noir

May 22, 2025

Rediscovering A Classic Dennis Quaid Meg Ryan And James Caan In A Neglected Western Neo Noir

May 22, 2025 -

Addressing The Allegations The Blake Lively Story

May 22, 2025

Addressing The Allegations The Blake Lively Story

May 22, 2025

Latest Posts

-

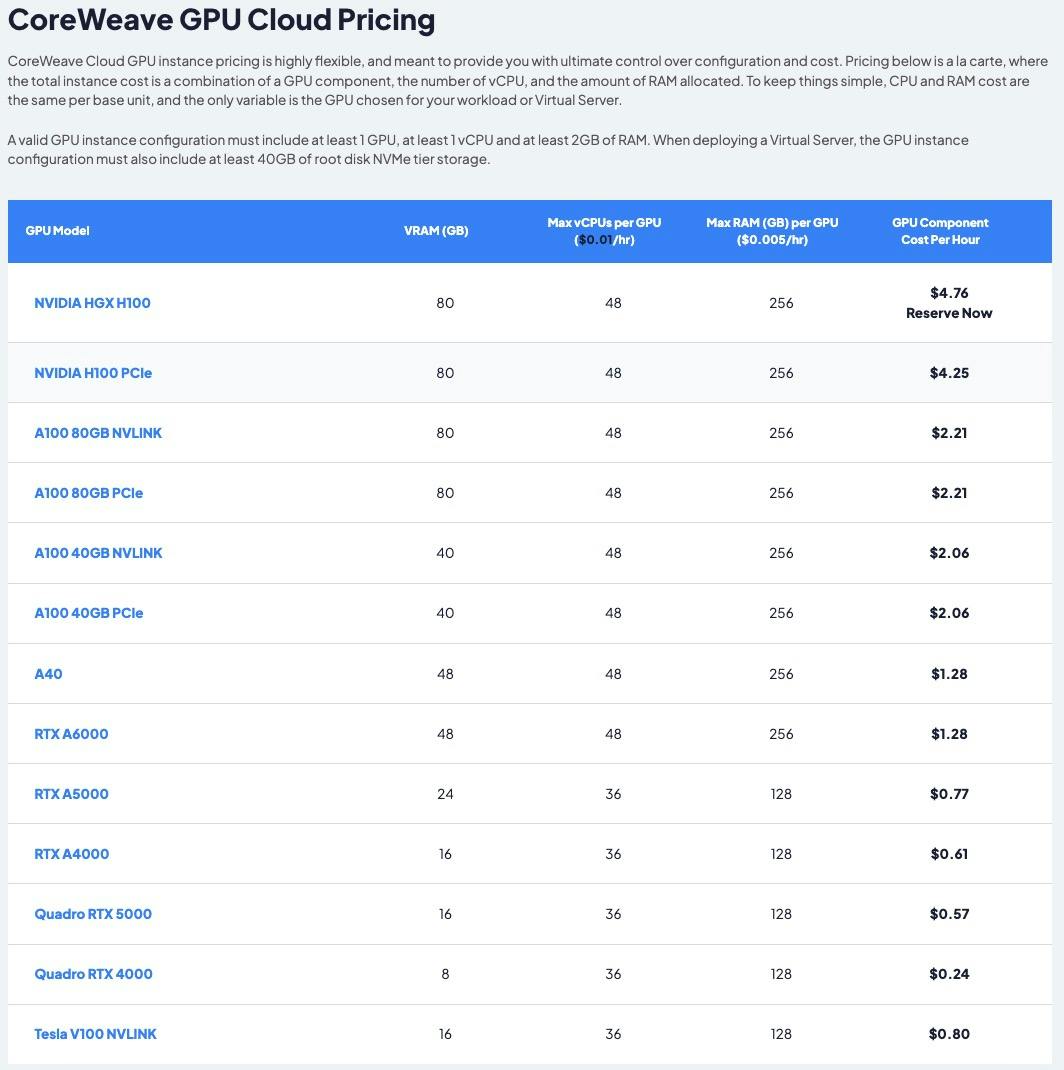

Is Core Weave Stock A Good Investment Current Market Analysis

May 22, 2025

Is Core Weave Stock A Good Investment Current Market Analysis

May 22, 2025 -

Core Weave Stock A Deep Dive Into Recent Developments

May 22, 2025

Core Weave Stock A Deep Dive Into Recent Developments

May 22, 2025 -

Investment In Core Weave Crwv Understanding Last Weeks Market Activity

May 22, 2025

Investment In Core Weave Crwv Understanding Last Weeks Market Activity

May 22, 2025 -

Analyzing The Current State Of Core Weave Stock

May 22, 2025

Analyzing The Current State Of Core Weave Stock

May 22, 2025 -

Analyzing The Recent Increase In Core Weave Crwv Stock Value

May 22, 2025

Analyzing The Recent Increase In Core Weave Crwv Stock Value

May 22, 2025