Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF: Explained

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF aims to track the performance of the iconic Dow Jones Industrial Average (DJIA). This means the ETF's price should closely mirror the movements of this well-known US stock market index. As a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF, it adheres to strict European Union regulations, providing a high level of investor protection.

- Objective: To replicate the performance of the DJIA.

- Structure: UCITS compliant, offering regulatory oversight and investor safeguards.

- Benefits:

- Diversification: Gain exposure to 30 large, well-established US companies, reducing individual stock risk.

- Low Fees: Generally, ETFs have lower expense ratios than actively managed funds.

- Liquidity: Easy to buy and sell on exchanges.

- Transparency: Regularly published NAV and holdings information. Keywords: Amundi Dow Jones Industrial Average UCITS ETF, UCITS ETF, Dow Jones Industrial Average, DJIA, index tracking, diversification, investment benefits.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, usually at the close of the market. This process involves determining the total value of the ETF's assets and subtracting its liabilities.

- Assets: This includes the market value of all the stocks held within the ETF, mirroring the composition of the DJIA.

- Liabilities: This encompasses expenses like management fees, operating costs, and any accrued liabilities.

- Calculation: (Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV per share

- Fund Manager's Role: Amundi, as the fund manager, is responsible for overseeing the portfolio and ensuring the accurate valuation of assets, ultimately determining the daily NAV.

Keywords: NAV calculation, Amundi Dow Jones Industrial Average UCITS ETF, assets under management (AUM), liabilities, fund manager, daily NAV, valuation.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF NAV.

- Dow Jones Industrial Average Performance: The primary driver of NAV changes is the performance of the underlying DJIA. If the index rises, so too should the ETF's NAV (and vice versa).

- Currency Fluctuations: If you invest in a currency different from the ETF's base currency (usually USD), exchange rate movements will impact your returns. A stronger USD will decrease the NAV in other currencies.

- Management Fees and Expenses: The expense ratio (management fees and other operational costs) directly impacts the NAV, albeit usually only slightly.

Keywords: NAV fluctuations, Dow Jones Industrial Average, currency exchange rates, management fees, expense ratio, market volatility.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF?

Accessing the real-time or historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward.

- Amundi Website: The official Amundi website is a primary source for this information.

- Financial News Sources: Many financial news websites and portals display real-time ETF pricing, including the NAV.

- Brokerage Platforms: Your brokerage account will show the current NAV and historical data for any ETFs you hold or are considering investing in.

It's crucial to check the NAV before buying or selling shares to ensure you're getting a fair price.

Keywords: NAV data, Amundi website, real-time NAV, historical NAV, brokerage platforms, financial news sources.

Using NAV to Make Informed Investment Decisions

Understanding the NAV is a key tool for making informed decisions.

- Performance Comparison: Compare the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF against other investment options to assess its relative performance.

- Market Timing (Use with Caution): Monitoring NAV changes might inform your entry and exit strategies; however, market timing is risky and shouldn't be the sole basis for investment decisions.

- Risk Management: Understanding NAV fluctuations helps you assess the risk associated with your investment.

Remember, while NAV is vital, it's just one piece of the puzzle. Consider your overall investment strategy, risk tolerance, and financial goals.

Keywords: investment decisions, ETF performance, market timing, risk management, investment strategy.

Conclusion: Mastering the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is fundamental to successful ETF investing. By regularly monitoring the NAV, comparing performance, and considering other relevant factors, you can make more informed investment decisions. Remember to check the NAV on reputable sources before any trading activity. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF NAV and start making informed investment decisions today!

Featured Posts

-

90 Let Sergeyu Yurskomu Pamyat O Genii Paradoksov

May 24, 2025

90 Let Sergeyu Yurskomu Pamyat O Genii Paradoksov

May 24, 2025 -

Sharp Decline In Amsterdam Stock Index Lowest Point In Over A Year

May 24, 2025

Sharp Decline In Amsterdam Stock Index Lowest Point In Over A Year

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Past Florida Film Festival Guests Mia Farrow And Christina Ricci

May 24, 2025

Past Florida Film Festival Guests Mia Farrow And Christina Ricci

May 24, 2025 -

Philips Future Health Index 2025 Urgent Call To Action For Healthcare Leaders

May 24, 2025

Philips Future Health Index 2025 Urgent Call To Action For Healthcare Leaders

May 24, 2025

Latest Posts

-

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025 -

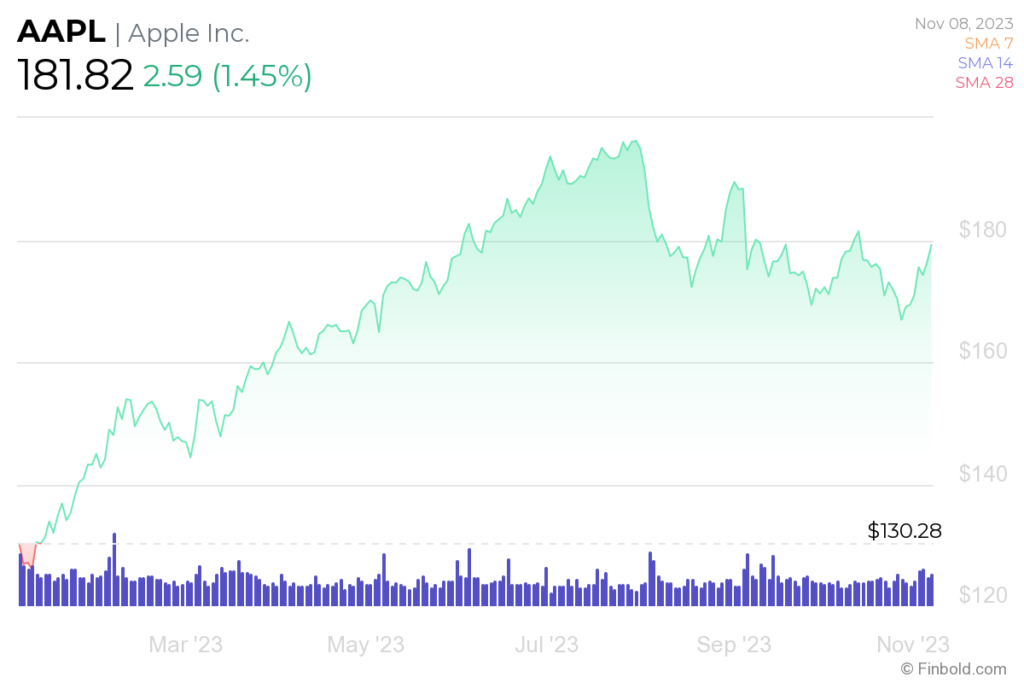

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025 -

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025 -

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025 -

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025