Repairing Your Credit After Late Student Loan Payments

Table of Contents

Understanding the Impact of Late Student Loan Payments on Your Credit

Late student loan payments can severely impact your creditworthiness. Your credit score, particularly your FICO score (the most widely used credit scoring model), is directly affected by negative marks on your credit report, often referred to as derogatory marks. These marks indicate a history of missed or late payments.

- Late payments remain on your credit report for 7 years. This means the negative impact lingers for a considerable period.

- Late payments significantly lower your credit score. Even a single late payment can cause a noticeable drop. Multiple late payments can significantly damage your score.

- A lower credit score can impact loan approvals, interest rates, and even employment opportunities. Lenders see a lower score as a higher risk, leading to higher interest rates or even loan denials. Some employers also perform credit checks as part of the hiring process.

It's crucial to understand the difference between a late payment and a delinquent payment. A late payment is simply a payment made after the due date. A delinquent payment is a payment that is significantly overdue, often triggering more serious consequences, including potential legal action from your loan servicer.

Steps to Take Immediately After a Missed Student Loan Payment

Acting swiftly after missing a student loan payment is crucial to mitigating further damage to your credit.

-

Contact your loan servicer immediately. Explain your situation honestly. They might offer options to avoid further delinquency, such as a short-term forbearance or deferment.

-

Review your loan terms and payment options. Understanding your loan agreement is key. Explore options like income-driven repayment plans if you qualify. These plans base your monthly payment on your income and family size. Consolidating your loans into a single payment may also simplify your finances and reduce the risk of future missed payments.

-

Here's what you should do:

- Document all communication with your loan servicer. Keep copies of emails, letters, and phone call notes.

- Explore income-driven repayment plans if eligible. These plans can significantly lower your monthly payments.

- Consider consolidating your loans to simplify payments. This can help you manage your debt more effectively.

Strategies for Repairing Your Credit After Late Student Loan Payments

Repairing your credit after late student loan payments requires a multi-pronged approach focused on responsible financial behavior and consistent effort.

-

Pay down existing debt. Lowering your credit utilization ratio (the amount of credit you're using compared to your total available credit) is crucial. Focus on paying down high-interest debt like credit cards first.

-

Make all future student loan payments on time. Consistency is key. Establish a reliable system to ensure timely payments.

-

Here's how to improve:

- Set up automatic payments. This is the easiest way to avoid missed payments.

- Budget effectively. Create a realistic budget to manage your expenses and prioritize loan repayments.

- Consider using credit counseling services. These services can provide guidance on debt management strategies and budgeting.

-

Dispute any inaccuracies on your credit report. Check your credit reports regularly (using AnnualCreditReport.com) and dispute any errors or outdated information.

Building Positive Credit History

After addressing your late payments, focus on building positive credit history to offset the negative marks.

-

Open a secured credit card. This requires a security deposit, but it helps establish a positive payment history.

-

Become an authorized user on a credit card with a good payment history. This can positively impact your credit score if the primary cardholder maintains a strong payment record.

-

Here's what to do:

- Monitor your credit reports regularly. Check for errors and track your progress.

- Gradually increase your credit limit. As your credit score improves, you can request a higher credit limit.

- Avoid opening multiple new credit accounts within a short period. This can negatively affect your credit score.

Seeking Professional Help

Sometimes, professional guidance is invaluable in navigating the complexities of credit repair.

-

Credit counseling and debt management plans can provide expert advice and support. They can help you create a budget, negotiate with creditors, and develop a plan to pay off your debt.

-

Professional help is most beneficial when you're overwhelmed by debt or struggling to manage payments. Don't hesitate to seek assistance if you need it.

-

Consider these actions:

- Find a reputable credit counseling agency. Look for agencies certified by the National Foundation for Credit Counseling (NFCC).

- Understand the fees and terms of any credit counseling program. Avoid agencies with hidden fees or unrealistic promises.

- Explore debt consolidation options if recommended by a professional. This can simplify your payments and potentially lower your interest rates.

Conclusion

Recovering from late student loan payments and repairing your credit takes time and effort, but it’s achievable. By consistently following these steps – from immediate action with your loan servicer to building positive credit history and seeking professional help when needed – you can rebuild your financial standing. Remember, proactive management and responsible financial habits are key to successfully repairing your credit after late student loan payments and securing a brighter financial future. Don't hesitate to take control of your finances and begin the process of repairing your credit score today!

Featured Posts

-

High School Confidential 2024 25 Week 26 Highlights

May 17, 2025

High School Confidential 2024 25 Week 26 Highlights

May 17, 2025 -

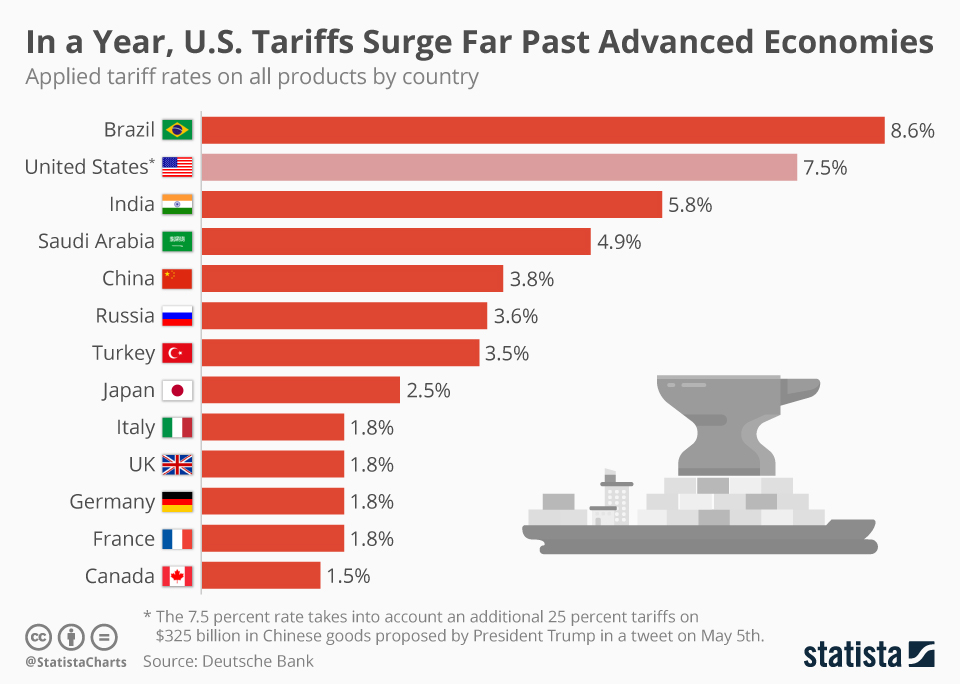

Rep Jasmine Crockett Trumps Impact On Grocery Prices And Wages

May 17, 2025

Rep Jasmine Crockett Trumps Impact On Grocery Prices And Wages

May 17, 2025 -

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025 -

Anonymous Online Gambling Top No Kyc Casino Sites Of 2025

May 17, 2025

Anonymous Online Gambling Top No Kyc Casino Sites Of 2025

May 17, 2025 -

May 16th Oil Market Report Prices Trends And Analysis

May 17, 2025

May 16th Oil Market Report Prices Trends And Analysis

May 17, 2025

Latest Posts

-

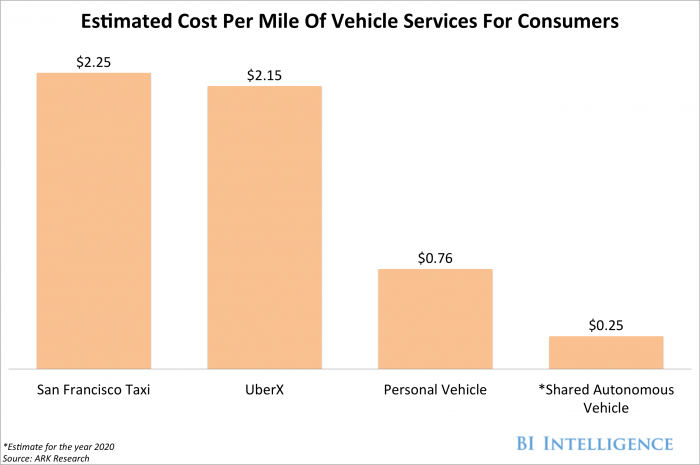

Ubers Self Driving Cars Are These Etfs A Smart Investment

May 17, 2025

Ubers Self Driving Cars Are These Etfs A Smart Investment

May 17, 2025 -

New Zealands Best Online Casinos A Comprehensive Guide Featuring 7 Bit Casino

May 17, 2025

New Zealands Best Online Casinos A Comprehensive Guide Featuring 7 Bit Casino

May 17, 2025 -

Uber Stock And Recession Why Analysts See Resilience

May 17, 2025

Uber Stock And Recession Why Analysts See Resilience

May 17, 2025 -

Investing In Ubers Autonomous Vehicle Future An Etf Analysis

May 17, 2025

Investing In Ubers Autonomous Vehicle Future An Etf Analysis

May 17, 2025 -

Could Driverless Uber Pay Off Etf Investing In Autonomous Vehicle Technology

May 17, 2025

Could Driverless Uber Pay Off Etf Investing In Autonomous Vehicle Technology

May 17, 2025