Riot Platforms, Inc. Announces Waiver And Irrevocable Proxy

Table of Contents

Understanding the Riot Platforms, Inc. Waiver and Irrevocable Proxy

The announcement of a "waiver and irrevocable proxy" might sound complicated, but the core concepts are relatively straightforward. In this context, a waiver refers to the relinquishment of certain rights, often by a shareholder. An irrevocable proxy, on the other hand, is an agreement granting another party the right to vote on behalf of a shareholder, even if the shareholder later changes their mind. This arrangement is typically binding and cannot be easily revoked.

- Specifics of the Waiver: The exact details of the waiver granted by Riot Platforms, Inc. need to be examined in the official company filings. This may involve the waiver of certain contractual obligations or rights related to shareholder agreements or debt financing.

- Specifics of the Irrevocable Proxy: Similarly, the precise terms of the irrevocable proxy require careful review of the company's announcements. This would likely involve specifying the individual or entity granted the proxy and the scope of voting rights they now hold.

- Grantor of the Waiver and Proxy: Determining who granted the waiver and proxy is crucial for understanding the motivations behind this action. This information should be publicly available in Riot's official disclosures.

- Purpose of the Action: The stated purpose behind this maneuver might involve various strategic objectives, such as streamlining shareholder voting processes, facilitating debt restructuring, or achieving strategic alignment with key partners.

Implications for Riot Platforms, Inc. Stock

The announcement of a waiver and irrevocable proxy can have both positive and negative impacts on RIOT's stock price.

- Potential Positive Impacts: The action could lead to increased efficiency in decision-making and potentially strengthen the company's financial position, making it more attractive to investors. A successful debt restructuring, for example, could significantly improve Riot's balance sheet.

- Potential Negative Impacts: On the other hand, there's a risk of potential dilution for existing shareholders, or a perceived loss of control if significant voting power shifts to a third party. This could lead to negative market sentiment and pressure on the stock price.

- Market Reaction and Analyst Predictions: Analyzing the immediate market reaction to the announcement, as well as reviewing any subsequent reports and predictions from financial analysts, provides valuable insights into investor sentiment and future expectations for RIOT stock. Tracking RIOT's stock price over the following weeks and months will be crucial in assessing the true impact.

Impact on Bitcoin Mining and the Cryptocurrency Market

Riot Platforms' actions ripple beyond its own stock. The ripple effect on the Bitcoin mining industry and the broader cryptocurrency market deserves close examination.

- Competitive Landscape: This move could impact the competitive landscape of Bitcoin mining, potentially shifting the balance of power among major players. Competitors might respond with similar strategic adjustments.

- Energy Consumption and Sustainability: The implications for energy consumption and sustainability within Bitcoin mining are significant. Riot's decision might influence industry-wide efforts toward greener mining practices.

- Regulatory Implications: The announcement could indirectly affect the regulatory landscape of the cryptocurrency market, influencing the ongoing debate about the environmental and financial risks of cryptocurrency mining.

Analyzing the Long-Term Strategy of Riot Platforms, Inc.

Understanding the long-term strategy behind Riot Platforms' decision is key to assessing its implications.

- Strategic Rationale: The company's rationale for granting the waiver and irrevocable proxy needs careful consideration. Is it a defensive measure, an offensive maneuver, or a simple streamlining of operations?

- Long-Term Goals: This action should be viewed within the context of Riot's broader long-term goals and ambitions within the Bitcoin mining space. This could include expansion plans, technological upgrades, or market share dominance.

- Benefits and Risks: Weighing the potential benefits (e.g., improved financial stability, strategic partnerships) against the risks (e.g., dilution, loss of control) is crucial for a comprehensive analysis. Comparing Riot's strategy with those of other major Bitcoin miners like Marathon Digital Holdings and Canaan Inc. provides valuable context.

Conclusion: The Future of Riot Platforms, Inc. After the Waiver and Irrevocable Proxy Announcement

The "Riot Platforms, Inc. Announces Waiver and Irrevocable Proxy" announcement presents a complex picture with both opportunities and potential risks for the company and the wider cryptocurrency market. The impact on RIOT stock price will likely depend on the successful execution of the strategy behind this decision and the broader market conditions. Understanding the specific details of the waiver and proxy, and carefully monitoring the market's reaction, are essential for investors.

To stay informed about Riot Platforms, Inc. and its future developments, follow reputable financial news sources, conduct thorough research on the “Riot Platforms, Inc. Announces Waiver and Irrevocable Proxy” announcement, and consider consulting a financial advisor before making any investment decisions related to Riot Platforms, Inc. (RIOT) stock. Remember, thorough due diligence is paramount when investing in the volatile cryptocurrency market.

Featured Posts

-

Christina Aguilera Fans Accuse Singer Of Excessive Photoshopping In New Photoshoot

May 03, 2025

Christina Aguilera Fans Accuse Singer Of Excessive Photoshopping In New Photoshoot

May 03, 2025 -

Reform Uk Mp Suspended Lowes Account Of Farage Incident

May 03, 2025

Reform Uk Mp Suspended Lowes Account Of Farage Incident

May 03, 2025 -

Where To Buy Harry Potter Merchandise Online For International Harry Potter Day

May 03, 2025

Where To Buy Harry Potter Merchandise Online For International Harry Potter Day

May 03, 2025 -

From Missouri To 500 Nhl Points Clayton Kellers Achievement

May 03, 2025

From Missouri To 500 Nhl Points Clayton Kellers Achievement

May 03, 2025 -

Ai Driven Podcast Creation Transforming Repetitive Documents Into Compelling Audio

May 03, 2025

Ai Driven Podcast Creation Transforming Repetitive Documents Into Compelling Audio

May 03, 2025

Latest Posts

-

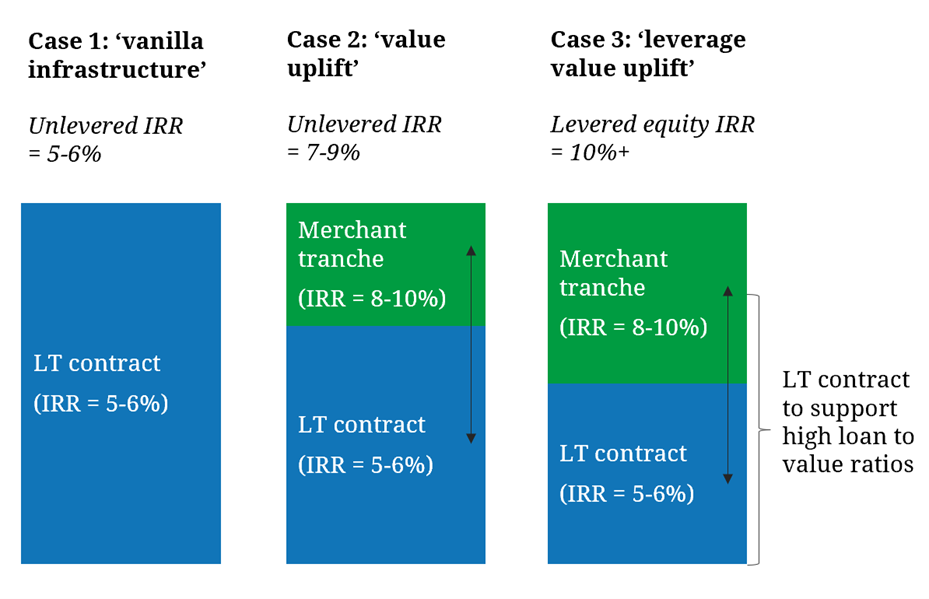

Belgiums Energy Landscape Financing Options For A 270 M Wh Bess Project

May 04, 2025

Belgiums Energy Landscape Financing Options For A 270 M Wh Bess Project

May 04, 2025 -

Case Study Financing A 270 M Wh Bess In Belgiums Merchant Market

May 04, 2025

Case Study Financing A 270 M Wh Bess In Belgiums Merchant Market

May 04, 2025 -

Risk Assessment And Mitigation In Financing A 270 M Wh Bess Project In Belgium

May 04, 2025

Risk Assessment And Mitigation In Financing A 270 M Wh Bess Project In Belgium

May 04, 2025 -

Financial Models For A 270 M Wh Battery Energy Storage System Bess Project In Belgium

May 04, 2025

Financial Models For A 270 M Wh Battery Energy Storage System Bess Project In Belgium

May 04, 2025 -

Investment Strategies For A 270 M Wh Bess In Belgiums Competitive Energy Market

May 04, 2025

Investment Strategies For A 270 M Wh Bess In Belgiums Competitive Energy Market

May 04, 2025