Rockwell Automation Leads Wednesday's Market Gains

Table of Contents

Rockwell Automation's Stock Price Surge

Percentage Increase and Closing Price

On Wednesday, Rockwell Automation's stock price experienced a remarkable X% increase, closing at $XXX per share. This substantial gain represents a significant jump from the previous day's closing price and underscores the positive market sentiment surrounding the company.

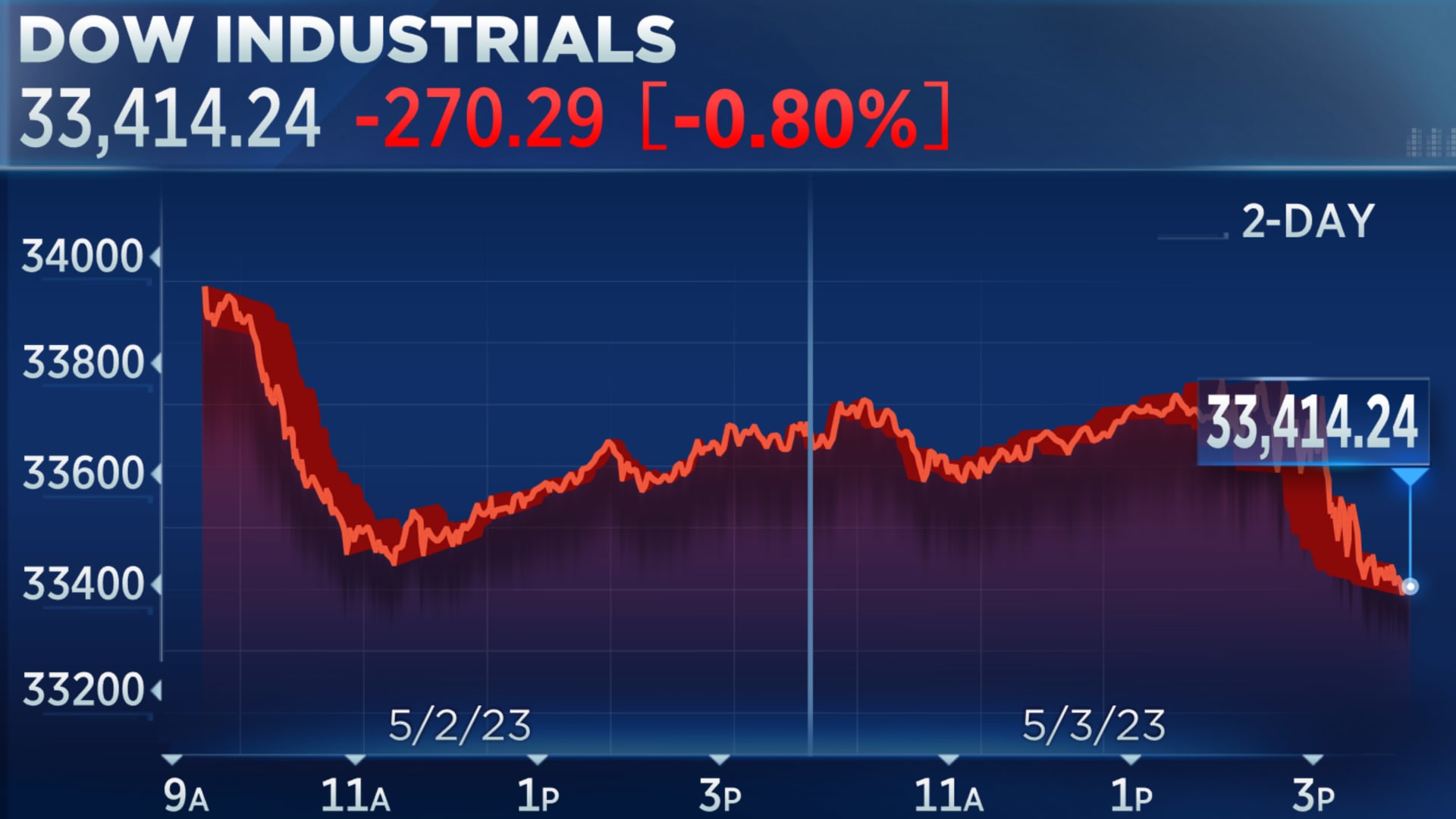

Comparison to Market Indices

Rockwell Automation's performance significantly outpaced major market indices:

- Outperformed the S&P 500 by X%: While the S&P 500 saw a modest increase, Rockwell Automation's gains were considerably higher, demonstrating its exceptional performance relative to the broader market.

- Surpassed the Dow Jones by Y%: Compared to the Dow Jones Industrial Average, Rockwell Automation's stock exhibited even more robust growth, highlighting its resilience in the current market conditions.

- Significantly outpaced the Nasdaq by Z%: The technology-heavy Nasdaq also lagged behind Rockwell Automation's impressive gains, further emphasizing the unique strength of the industrial automation sector and Rockwell Automation's position within it.

Trading Volume

The trading volume for Rockwell Automation on Wednesday was significantly higher than average, indicating strong investor activity and a surge in buying pressure. This elevated trading volume suggests a considerable level of confidence in the company's future prospects.

Potential Factors Contributing to the Gains

Positive Earnings Report (if applicable)

(This section should be adapted based on the actual earnings report. If no report was recently released, remove this section or replace it with other relevant factors.)

Rockwell Automation's recent earnings report exceeded expectations, bolstering investor confidence:

- Exceeding earnings expectations: The company reported earnings per share (EPS) of $X.XX, surpassing analyst estimates of $X.XX.

- Strong revenue growth: Revenue increased by X% year-over-year, driven by strong demand for its automation solutions across various industries.

- Positive outlook for future quarters: Management expressed confidence in the company's future performance, projecting continued growth in the coming quarters. This positive outlook reassured investors.

Industry-Specific News

Several positive developments within the industrial automation sector contributed to the favorable market sentiment:

- Increased demand for automation solutions: The ongoing trend of automation across manufacturing and other industries is fueling demand for Rockwell Automation's products and services.

- Government initiatives supporting automation: Government policies promoting automation and technological advancement are creating a favorable environment for companies like Rockwell Automation.

- Strategic partnerships or acquisitions: Recent strategic partnerships or acquisitions by Rockwell Automation (if applicable) could also have contributed positively to investor sentiment.

Analyst Upgrades and Ratings

Several financial analysts upgraded their ratings for Rockwell Automation, citing the company's strong performance and positive outlook. These upgrades likely played a significant role in boosting investor confidence and driving the stock price higher.

Investor Sentiment and Future Outlook for Rockwell Automation

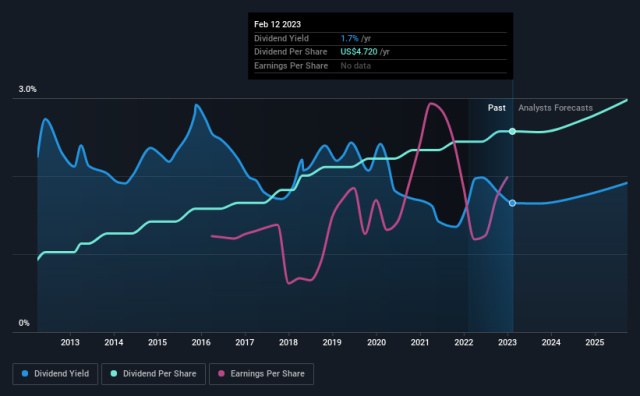

Analyst Predictions

Analysts predict continued growth for Rockwell Automation, with several forecasting further price increases in the coming months. This positive outlook reflects the market's belief in the company's long-term potential.

Long-Term Investment Potential

Rockwell Automation's strong market position, coupled with positive industry trends and technological innovation, suggests significant long-term investment potential. Its leadership in industrial automation positions it well for continued success.

Risks and Challenges

While the outlook for Rockwell Automation is positive, it's essential to acknowledge potential risks, such as increased competition, economic downturns, and supply chain disruptions. These factors should be considered when evaluating the investment potential.

Conclusion

Rockwell Automation's impressive market gains on Wednesday, a remarkable X% increase outperforming major indices, were driven by a confluence of factors, including a strong earnings report (if applicable), positive industry trends, and analyst upgrades. The company's robust position in the industrial automation sector and positive future outlook suggest continued strong performance. Stay informed about the latest developments in Rockwell Automation's performance and explore the potential investment opportunities in this leading industrial automation company. Want to delve deeper into Rockwell Automation's stock performance and future prospects? Conduct thorough research into the company's financials and market position to make informed investment decisions.

Featured Posts

-

From Disaster To Success How Thibodeau Reshaped The New York Knicks

May 17, 2025

From Disaster To Success How Thibodeau Reshaped The New York Knicks

May 17, 2025 -

Anonymous Online Gambling Top No Kyc Casino Sites Of 2025

May 17, 2025

Anonymous Online Gambling Top No Kyc Casino Sites Of 2025

May 17, 2025 -

Srbija Na Evrobasketu Pripremna Utakmica U Minhenu Analiza I Vesti

May 17, 2025

Srbija Na Evrobasketu Pripremna Utakmica U Minhenu Analiza I Vesti

May 17, 2025 -

Thibodeaus Transformation Overcoming Past Flaws To Resurrect The Knicks

May 17, 2025

Thibodeaus Transformation Overcoming Past Flaws To Resurrect The Knicks

May 17, 2025 -

How Luxury Real Estate Offers Stability Amidst Market Volatility For High Net Worth Individuals

May 17, 2025

How Luxury Real Estate Offers Stability Amidst Market Volatility For High Net Worth Individuals

May 17, 2025

Latest Posts

-

Rockwell Automation Earnings Surprise Stock Soars With Other Market Leaders

May 17, 2025

Rockwell Automation Earnings Surprise Stock Soars With Other Market Leaders

May 17, 2025 -

Stock Market Update Strong Earnings Boost Rockwell Automation And Other Big Names

May 17, 2025

Stock Market Update Strong Earnings Boost Rockwell Automation And Other Big Names

May 17, 2025 -

Brunson Injury Highlights Knicks Critical Flaw

May 17, 2025

Brunson Injury Highlights Knicks Critical Flaw

May 17, 2025 -

Rockwell Automation Earnings Beat Expectations Wednesdays Stock Market Winners

May 17, 2025

Rockwell Automation Earnings Beat Expectations Wednesdays Stock Market Winners

May 17, 2025 -

Ankle Sprain Sidelines Brunson Return Expected Sunday

May 17, 2025

Ankle Sprain Sidelines Brunson Return Expected Sunday

May 17, 2025