Understanding Amundi Dow Jones Industrial Average UCITS ETF Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the total value of the 30 constituent companies of the Dow Jones Industrial Average, held within the ETF, after deducting expenses. Crucially, the NAV differs from the market price, which fluctuates throughout the trading day. The NAV is typically calculated once per day, usually at the market close.

- NAV represents the underlying asset value of the ETF. This is a key distinction from the market price, which can be influenced by supply and demand.

- Market price fluctuates throughout the trading day, while NAV is calculated daily. This means you might see discrepancies between the two figures.

- Differences between NAV and market price can indicate arbitrage opportunities (for sophisticated traders). When the market price deviates significantly from the NAV, experienced investors might seek to profit from this discrepancy. However, this is a complex strategy and not suitable for all investors.

How is the Amundi Dow Jones Industrial Average UCITS ETF NAV Calculated?

The calculation of the Amundi Dow Jones Industrial Average UCITS ETF NAV involves several steps. First, the market value of each of the 30 constituent companies within the Dow Jones Industrial Average is determined at the market close. The ETF's holdings are then valued based on these closing prices, considering the number of shares held in each company. Next, the total asset value is calculated by summing the values of all holdings.

- The ETF replicates the Dow Jones Industrial Average, so the NAV is directly influenced by the performance of its 30 constituent companies. Therefore, tracking the Dow Jones Industrial Average is crucial for understanding the potential movements of the ETF's NAV.

- Transaction costs and management fees are deducted from the total asset value to arrive at the NAV. These expenses are reflected in the final NAV figure.

- Currency fluctuations can also impact the NAV if the ETF holds assets in different currencies. This is especially relevant for internationally diversified ETFs.

- Reference to official documentation or resources for precise calculation details. For the most accurate and detailed information on the NAV calculation methodology, it is advisable to consult the official documentation provided by Amundi.

The Importance of Monitoring Amundi Dow Jones Industrial Average UCITS ETF NAV

Monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for several reasons. It allows you to assess the ETF's performance over time, providing a clearer picture of your investment's growth. Comparing the NAV to the market price can help you understand market sentiment and potential arbitrage opportunities. Furthermore, tracking the NAV is useful for evaluating the effectiveness of your investment strategy.

- Regularly checking the NAV helps track the ETF's growth over time. This provides a clear picture of your investment’s long-term performance.

- Comparing NAV changes to market price fluctuations can reveal insights into market sentiment. A significant divergence might suggest market overreaction or undervaluation.

- Using NAV to assess the effectiveness of your investment strategy. You can compare your returns against benchmarks to see if your strategy is working.

- Understanding NAV helps in making buy/sell decisions based on value. Buying low and selling high, relative to the NAV, can improve investment returns.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Finding the daily Amundi Dow Jones Industrial Average UCITS ETF NAV is straightforward. Several reliable sources provide this information.

- Amundi's official website: The ETF provider's website is usually the most reliable source.

- Major financial data providers (e.g., Bloomberg, Refinitiv): These platforms offer detailed financial information, including ETF NAVs.

- Your brokerage account platform: Most brokerage accounts provide real-time or daily updates on your ETF holdings, including the NAV.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for any investor. By monitoring the NAV and understanding how it's calculated, you can effectively track your investment's performance, assess its value, and optimize your investment strategy. Regularly review the Amundi Dow Jones Industrial Average UCITS ETF NAV to stay informed and make the most of your investment in this significant index-tracking ETF. Start tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV today!

Featured Posts

-

Mengungkap Sejarah Porsche 356 Perjalanan Dari Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Perjalanan Dari Zuffenhausen Jerman

May 24, 2025 -

The Kyle Walker Situation Party Pictures And Relationship Fallout

May 24, 2025

The Kyle Walker Situation Party Pictures And Relationship Fallout

May 24, 2025 -

Live Euro Boven 1 08 Terwijl Kapitaalmarktrentes Stijgen

May 24, 2025

Live Euro Boven 1 08 Terwijl Kapitaalmarktrentes Stijgen

May 24, 2025 -

Mathieu Avanzi Le Francais Bien Plus Qu Une Langue Scolaire

May 24, 2025

Mathieu Avanzi Le Francais Bien Plus Qu Une Langue Scolaire

May 24, 2025 -

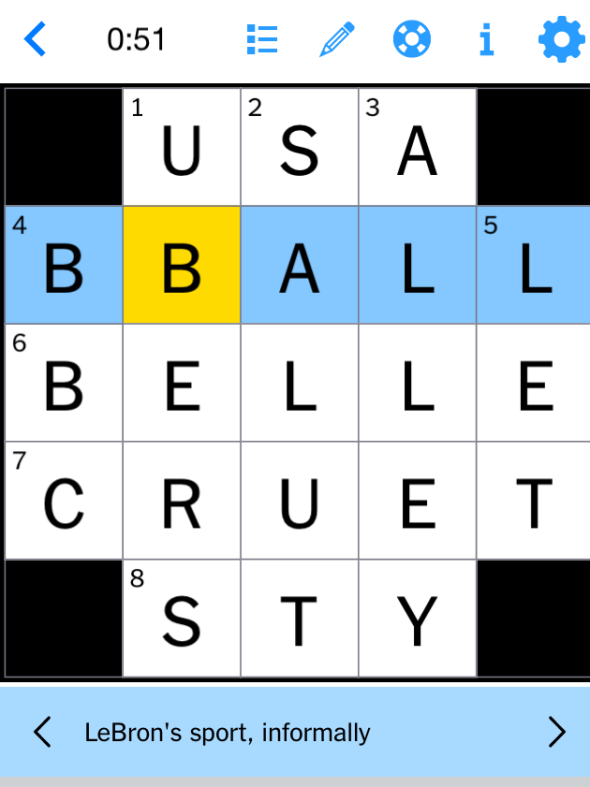

Nyt Mini Crossword March 26 2025 Hints To Help You Solve

May 24, 2025

Nyt Mini Crossword March 26 2025 Hints To Help You Solve

May 24, 2025

Latest Posts

-

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025