Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the NAV reflects the total value of the ETF's holdings in the 30 companies that make up the Dow Jones Industrial Average (DJIA). Think of it as the intrinsic value of the ETF, calculated daily, typically at market close.

The calculation is relatively straightforward: the total market value of all the ETF's holdings (shares of the DJIA companies) is determined. From this total, any liabilities (such as expenses) are subtracted. This net figure is then divided by the total number of outstanding ETF shares to arrive at the NAV per share. This provides a snapshot of the ETF's worth at a specific point in time.

- NAV represents the per-share value of the ETF's assets.

- Calculated daily, typically at market close.

- Reflects the total value of holdings minus liabilities, divided by the number of outstanding shares.

- Provides a snapshot of the ETF's intrinsic value.

Why is NAV Important for the Amundi Dow Jones Industrial Average UCITS ETF?

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for several reasons:

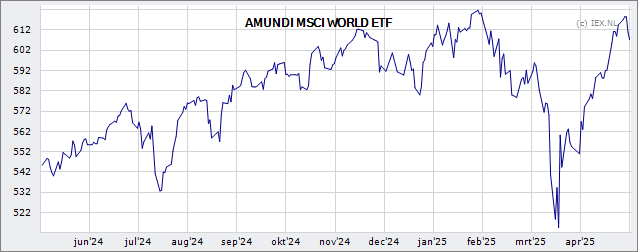

Investment Decisions: By comparing the ETF's market price to its NAV, you can determine if it's trading at a premium or a discount. A premium suggests the market is valuing the ETF higher than its underlying assets, while a discount indicates the opposite. This information can significantly impact your buy or sell decisions. Analyzing historical NAV data allows you to track the ETF's performance and make more informed investment choices. Monitoring Amundi Dow Jones Industrial Average UCITS ETF NAV trends can also help you time your entries and exits more effectively.

Pricing Transparency: The NAV ensures transparency in pricing. Investors have a clear understanding of the underlying value of their investment, free from market speculation that can influence the short-term price fluctuations. This is especially important for passively managed ETFs like this one which aims to track the DJIA's performance.

Risk Management: NAV fluctuations can help investors manage risk. By observing how the NAV changes over time, you can assess the volatility of your investment and adjust your risk tolerance accordingly. Understanding how the Amundi Dow Jones Industrial Average UCITS ETF NAV responds to market events is a key component of effective risk mitigation.

- Helps determine if the ETF is trading at a premium or discount to its NAV.

- Provides a benchmark for evaluating the ETF's performance relative to the DJIA.

- Crucial for understanding the value of your investment.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV?

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this crucial data:

- Amundi's official website: The ETF provider's website is the primary source for accurate and up-to-date NAV information.

- Major financial data providers: Reputable financial data providers like Bloomberg, Refinitiv, and Yahoo Finance typically include NAV data for major ETFs.

- Your brokerage account's platform: Most brokerage platforms display the NAV alongside the current market price of the ETF you hold in your portfolio.

- Financial news websites: Many financial news websites that offer ETF data will also provide the NAV.

Understanding NAV Differences and Market Price

While the NAV aims to reflect the intrinsic value, the market price can differ. This discrepancy stems from various factors, including supply and demand, bid-ask spreads (the difference between the buy and sell price), and market liquidity (how easily the ETF can be bought and sold). These differences are usually minor, but understanding them can improve your understanding of market dynamics.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is paramount for informed investment decisions. It provides pricing transparency, helps assess performance relative to the DJIA, and aids in risk management. Regularly checking the Amundi Dow Jones Industrial Average UCITS ETF NAV, alongside other key metrics, allows investors to make well-informed choices and effectively manage their investment in this popular ETF that tracks the performance of 30 leading American companies. Regularly checking the Amundi Dow Jones Industrial Average UCITS ETF NAV is key to successful investing in this popular ETF. Learn more about Amundi Dow Jones Industrial Average UCITS ETF NAV and other key investment metrics today!

Featured Posts

-

Importazioni Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025

Importazioni Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Camunda Con 2025 Amsterdam How Orchestration Drives Success In Ai And Automation

May 24, 2025

Camunda Con 2025 Amsterdam How Orchestration Drives Success In Ai And Automation

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025 -

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025

Latest Posts

-

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025