LVMH Stock Drops 8.2% On Disappointing Q1 Results

Table of Contents

Key Factors Contributing to LVMH's Q1 Stock Drop

LVMH's Q1 results fell short of expectations, leading to the considerable drop in its stock price. Several interconnected factors contributed to this disappointing performance.

Slower than Expected Growth in Key Markets

LVMH experienced slower-than-anticipated growth in several key markets, impacting its overall performance. This underperformance was particularly evident in specific product categories and geographic regions.

- China market slowdown: The crucial Chinese market displayed a significant slowdown, impacting sales of high-end watches and handbags. This is attributed to several factors, including stricter COVID-19 regulations earlier in the year and a general cooling of the luxury goods market in the region. Sales growth in this segment was reported at 5%, compared to analyst predictions of 12%.

- Reduced consumer spending in Europe: Inflationary pressures and rising interest rates in Europe led to reduced consumer spending on luxury goods. This impacted sales across several LVMH brands, with notable declines in fashion and leather goods. Sales growth in Europe was reported at 3%, significantly below the predicted 8%.

- North American Market Underwhelms: While generally strong, the North American market didn't meet projected growth rates. Increased competition and a potential shift in consumer spending towards experiences rather than luxury goods contributed to this slower-than-expected growth in this key region.

Impact of the Global Economic Slowdown

The global economic slowdown significantly impacted LVMH's Q1 performance. Factors such as persistent inflation, rising interest rates, and lingering geopolitical uncertainties are squeezing consumer spending, particularly in the luxury sector. High-end consumers are becoming more discerning, leading to a decrease in demand for luxury goods. Experts predict this trend will continue to affect the LVMH stock price in the near future.

Supply Chain Disruptions and Increased Costs

Lingering supply chain disruptions continue to present challenges for LVMH, impacting production and distribution. Increased raw material costs and higher logistics expenses further compressed profit margins. While LVMH has implemented strategies to mitigate these issues, the impact on profitability remains significant. The company is actively working to streamline its supply chain and secure alternative sourcing options.

Shifting Consumer Preferences

Changing consumer preferences are also playing a role. Younger generations, who are increasingly becoming key players in the luxury market, demonstrate a growing preference for sustainable and ethical brands. This shift is forcing luxury brands to adapt their strategies to appeal to this evolving demographic. LVMH is exploring strategies to incorporate sustainability and ethical practices across its brands to align with shifting consumer demands.

Investor Reactions and Market Analysis

The market reacted swiftly and negatively to LVMH's Q1 results. The significant 8.2% drop in the LVMH stock price reflects investor concerns about the company's near-term prospects.

Analyst Comments and Future Outlook

Financial analysts expressed mixed reactions, with some expressing concern about the company's ability to meet its full-year targets, citing the continued global economic uncertainty. Several analysts have lowered their price targets for LVMH stock, reflecting a more cautious outlook. However, others remain optimistic about LVMH's long-term growth potential, highlighting the company's strong brand portfolio and its capacity to adapt to changing market conditions.

Impact on the Broader Luxury Goods Sector

LVMH's decline has sent ripples through the broader luxury goods sector. Investors are closely watching other luxury brands for signs of similar weakness. The drop in LVMH's stock price raises questions about the overall health of the luxury goods market and its vulnerability to global economic headwinds. Other luxury conglomerates are also facing pressures, indicating a broader trend within the industry.

Trading Volume and Volatility

Following the release of the Q1 report, trading volume of LVMH stock surged, indicating heightened investor activity. The stock price experienced significant volatility, reflecting the uncertainty surrounding the company's future performance. This volatility presents both risks and opportunities for investors considering buying or selling LVMH shares.

Conclusion

The 8.2% drop in LVMH's stock price reflects a confluence of factors, including disappointing Q1 results, a challenging global economic environment, supply chain pressures, and evolving consumer preferences. This decline underscores the vulnerability of the luxury goods sector to macroeconomic headwinds and the importance of adapting to shifting consumer behavior. The impact on the broader luxury market is significant, prompting investors to closely monitor the performance of LVMH and its competitors.

Call to Action: Stay informed about the ongoing developments concerning LVMH stock price and the luxury goods market. Continue to monitor the performance of LVMH and related companies to make informed investment decisions. Regularly check for updates on LVMH's financial performance and market analysis to better understand the implications of this significant stock drop and navigate the evolving landscape of the luxury sector.

Featured Posts

-

Auto Legendas F1 Motorral Szerelt Porsche Koezuton

May 24, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuton

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perpaduan Seni Rupa Dan Mobil Klasik

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perpaduan Seni Rupa Dan Mobil Klasik

May 24, 2025 -

Demna Gvasalia Reshaping The Identity Of Gucci

May 24, 2025

Demna Gvasalia Reshaping The Identity Of Gucci

May 24, 2025 -

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025 -

Uusi Ferrari Kuljettaja 13 Vuotias Nimi Joka On Nyt Kaikkien Huulilla

May 24, 2025

Uusi Ferrari Kuljettaja 13 Vuotias Nimi Joka On Nyt Kaikkien Huulilla

May 24, 2025

Latest Posts

-

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

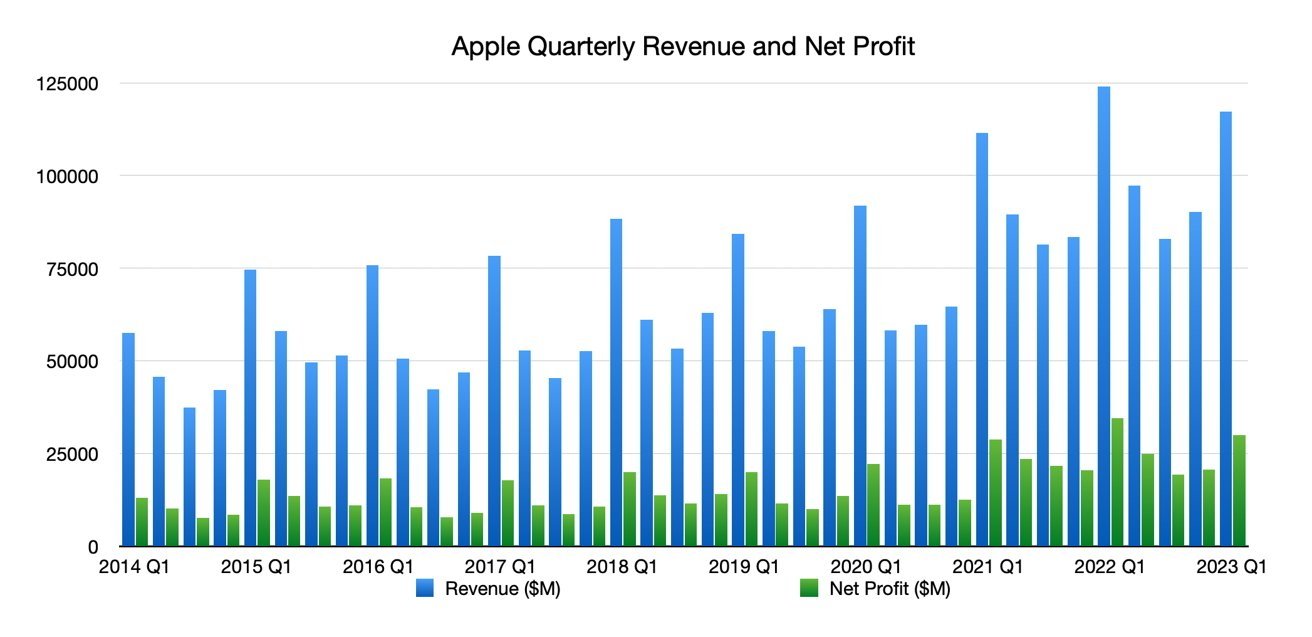

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025