Magnificent Seven's Market Cap Meltdown: $2.5 Trillion Lost This Year

Table of Contents

The Impact of Rising Interest Rates on Tech Valuations

Rising interest rates have significantly impacted investor sentiment toward growth stocks, a category in which the Magnificent Seven prominently reside. Higher interest rates increase the cost of borrowing for tech companies, hindering their ability to fund expansion and innovation. This directly affects future earnings projections, a crucial factor in determining a company's valuation using metrics like discounted cash flow (DCF) analysis. With higher discount rates, future earnings are worth less today, leading to lower valuations.

- Increased borrowing costs for tech companies: Tech companies often rely on debt financing for acquisitions, research and development, and expansion. Higher interest rates make this borrowing significantly more expensive.

- Reduced investor appetite for high-growth, high-valuation stocks: Investors are shifting towards more stable, dividend-paying stocks in a higher interest rate environment, reducing demand for growth stocks with high valuations.

- Shift towards more conservative investment strategies: The uncertainty created by rising interest rates encourages investors to adopt more conservative strategies, leading to a decrease in investment in riskier assets, such as high-growth tech stocks. This contributes directly to the Magnificent Seven's market cap meltdown.

Keywords: interest rate hikes, growth stock valuation, discounted cash flow, investor sentiment.

The Slowdown in Tech Spending and its Ripple Effect

A slowdown in both consumer and corporate tech spending has significantly impacted the revenues of the Magnificent Seven. Reduced consumer demand for tech products and services, coupled with decreased corporate investment in technology, creates a ripple effect throughout the industry. This is particularly evident in the advertising revenue of companies like Alphabet and Meta, which are heavily reliant on digital advertising.

- Decreased demand for tech products and services: Economic uncertainty and inflation are forcing consumers to tighten their belts, impacting sales of tech products and subscriptions to tech services.

- Supply chain disruptions and inflationary pressures: Persisting supply chain issues and inflation have increased production costs, reducing profit margins for tech companies.

- Impact on cloud computing and SaaS businesses: Even cloud computing and Software as a Service (SaaS) businesses, traditionally considered more recession-resistant, are experiencing slower growth as companies reduce their IT spending.

Keywords: tech spending slowdown, advertising revenue, consumer spending, cloud computing, SaaS.

Geopolitical Uncertainty and its Influence on Market Volatility

Geopolitical events, such as the ongoing war in Ukraine and escalating trade tensions, have added significant uncertainty to the global markets. This uncertainty directly impacts investor confidence and contributes to market volatility, negatively impacting the valuations of even the most robust tech companies. Disruptions to global supply chains further exacerbate these challenges.

- Increased market volatility due to global uncertainty: Geopolitical instability creates uncertainty, causing investors to react defensively and potentially sell off assets, including tech stocks.

- Disruptions to supply chains impacting production and sales: The war in Ukraine and other geopolitical events have disrupted global supply chains, impacting the production and sales of tech products.

- Investor concerns about geopolitical risks: Investors are increasingly concerned about the potential impact of geopolitical risks on the profitability and stability of tech companies, leading to sell-offs.

Keywords: geopolitical uncertainty, market volatility, supply chain disruptions, investor confidence.

The Rise of Competition and Emerging Technologies

The Magnificent Seven are facing increasing competition from smaller, more agile tech companies, particularly in emerging sectors like artificial intelligence. This intensified competition is pressuring market share and profitability, forcing the tech giants to invest heavily in innovation to maintain their leadership positions.

- Increased competition from smaller, more agile tech companies: Smaller companies are often more innovative and adaptable, posing a significant challenge to established players.

- The rise of artificial intelligence and other transformative technologies: The rapid development of AI and other disruptive technologies is reshaping the competitive landscape, creating both opportunities and challenges for the Magnificent Seven.

- The need for continuous innovation to maintain market leadership: The tech industry demands constant innovation. Failure to adapt to new technologies and changing market dynamics can lead to market share erosion and reduced profitability, contributing to the Magnificent Seven's market cap meltdown.

Keywords: tech competition, disruptive technologies, artificial intelligence, market share, innovation.

Conclusion: Understanding the Magnificent Seven's Market Cap Meltdown and What's Next

The $2.5 trillion market cap decline of the Magnificent Seven is a result of a confluence of factors, including rising interest rates, slowing tech spending, geopolitical uncertainty, and intensified competition. This significant loss underscores the challenges faced by even the most dominant tech companies in a rapidly changing global landscape. While the future remains uncertain, the Magnificent Seven's capacity for innovation and adaptation will determine their ability to navigate these headwinds and recover their market valuations.

To stay informed about the ongoing developments related to the Magnificent Seven's market cap meltdown and the future of the tech industry, subscribe to our newsletter, follow us on social media, and continue researching individual stock performances within the Magnificent Seven. Understanding these dynamics is crucial for navigating the complexities of the current market.

Featured Posts

-

Republican Revolt Will Trumps Tax Plan Face Defeat

Apr 29, 2025

Republican Revolt Will Trumps Tax Plan Face Defeat

Apr 29, 2025 -

International Recruitment The Impact Of Us Research Funding Reductions

Apr 29, 2025

International Recruitment The Impact Of Us Research Funding Reductions

Apr 29, 2025 -

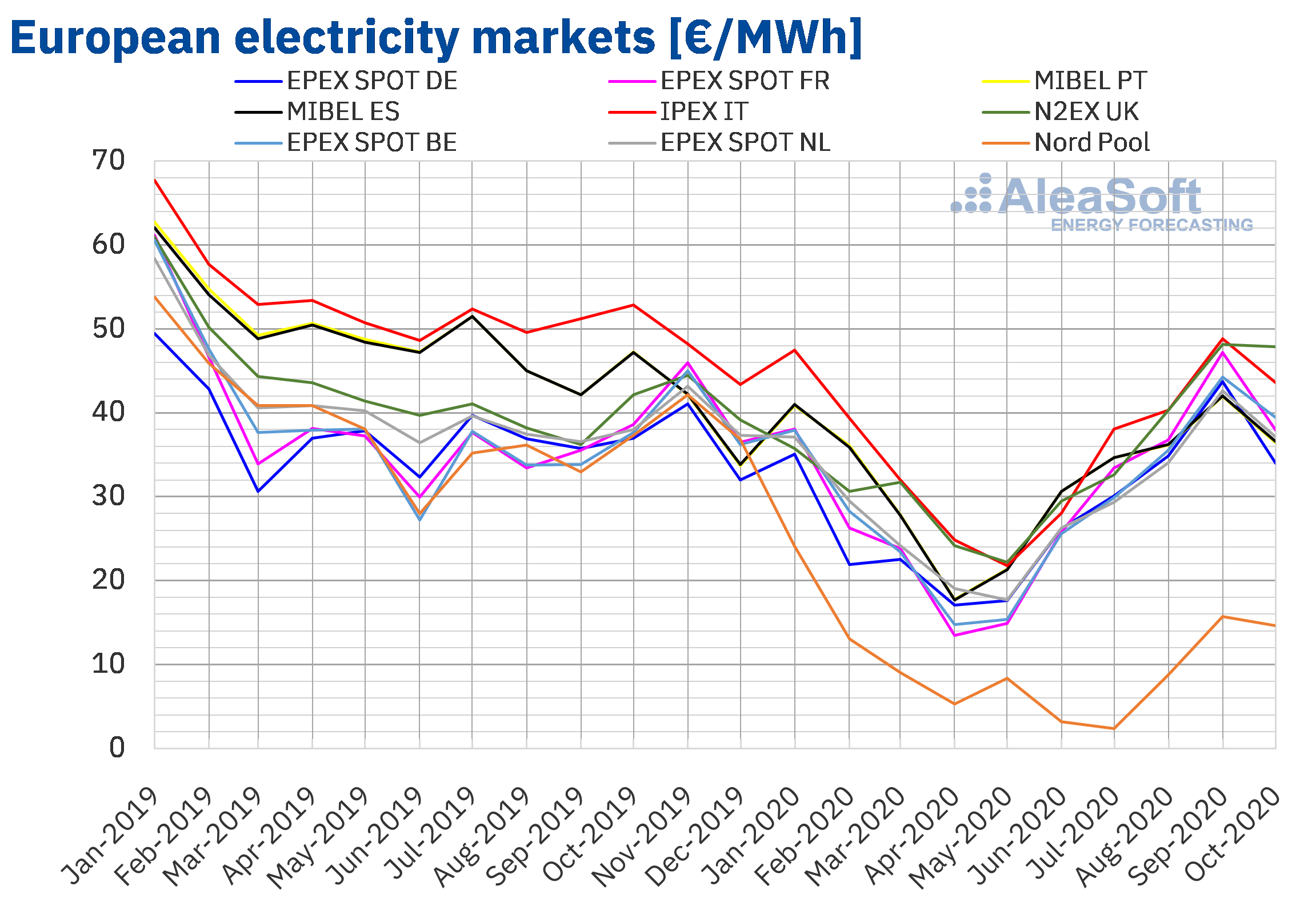

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025 -

Luxury Carmakers Face Headwinds In China More Than Just Bmw And Porsche

Apr 29, 2025

Luxury Carmakers Face Headwinds In China More Than Just Bmw And Porsche

Apr 29, 2025 -

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 29, 2025

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 29, 2025

Latest Posts

-

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 29, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 29, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Authorities Say

Apr 29, 2025

Office365 Executive Inboxes Targeted Millions Stolen Authorities Say

Apr 29, 2025 -

Navigating The Difficulties Of All American Production

Apr 29, 2025

Navigating The Difficulties Of All American Production

Apr 29, 2025 -

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025 -

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025