The Magnificent Seven's 2024 Decline: A $2.5 Trillion Market Value Plunge

Table of Contents

Factors Contributing to the Magnificent Seven's Decline

Several interconnected factors contributed to the significant decline in the Magnificent Seven's collective market capitalization. Understanding these factors is crucial to grasping the complexity of this market downturn.

Rising Interest Rates and Inflation

Higher interest rates significantly impacted tech valuations.

- Higher borrowing costs reduce company profitability: Increased borrowing costs directly affect a company's bottom line, reducing profitability and making future investments more expensive. This is particularly impactful for growth-oriented tech companies that often rely on debt financing.

- Inflation erodes purchasing power, impacting consumer spending: Inflation reduces the real value of money, impacting consumer spending on discretionary items, including many tech products and services. This decreased demand directly affects revenue and profits for tech giants.

- Specific examples: The Federal Reserve's aggressive interest rate hikes throughout 2023 and into 2024 directly impacted the Magnificent Seven. Increased borrowing costs led to reduced investment in research and development, impacting future growth prospects and ultimately affecting stock prices. For instance, Apple's expansion plans were reportedly scaled back due to the higher cost of capital.

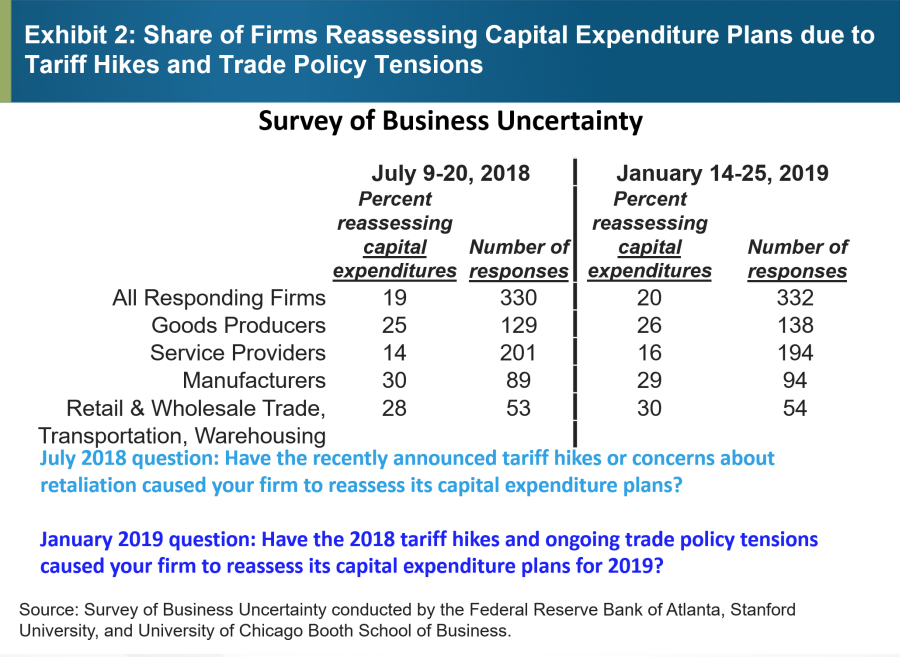

Geopolitical Uncertainty and Supply Chain Disruptions

Global instability and persistent supply chain issues significantly impacted the tech sector.

- Geopolitical tensions create market volatility: The war in Ukraine, ongoing trade tensions between the US and China, and other geopolitical events created significant market uncertainty, leading to increased volatility in tech stocks.

- Supply chain disruptions impact production and delivery: Ongoing disruptions to global supply chains, exacerbated by geopolitical factors and unforeseen events, led to delays in production and delivery of tech goods. This affected both the availability of products and the overall profitability of tech companies.

- Specific examples: The chip shortage, which persisted into 2024, impacted the production of iPhones and other tech devices, affecting Apple's revenue and impacting investor confidence. Similarly, disruptions to supply chains in Asia impacted the production and distribution of components for various tech products across the Magnificent Seven.

Increased Regulatory Scrutiny and Antitrust Concerns

Increased regulatory scrutiny and antitrust concerns added further pressure on the tech giants.

- Potential for increased fines and legal battles: Antitrust lawsuits and regulatory investigations can lead to significant fines and protracted legal battles, impacting profitability and diverting resources away from core business activities.

- Regulatory uncertainty affects investor confidence: The uncertainty surrounding future regulations can deter investment and negatively impact stock valuations. Investors become hesitant to invest in companies facing potential regulatory challenges.

- Specific examples: Ongoing antitrust investigations into Google's search dominance and Apple's App Store practices created regulatory uncertainty and impacted investor sentiment. Similar concerns regarding data privacy and market dominance affected other companies within the Magnificent Seven.

Sector-Specific Challenges within the Magnificent Seven

Beyond the macroeconomic factors, each company within the Magnificent Seven faced unique sector-specific challenges.

Apple's Slowdown in iPhone Sales

Apple, the world's most valuable company, experienced a slowdown in iPhone sales in 2024.

- Factors contributing to the decline: Market saturation, a global economic slowdown, and increased competition contributed to the decline in iPhone sales. Consumers were delaying upgrades or opting for lower-priced alternatives.

- Impact on market capitalization: The slower-than-expected iPhone sales growth directly impacted Apple's overall market capitalization, contributing to the overall decline of the Magnificent Seven.

Microsoft's Cloud Computing Competition

Microsoft, a dominant force in cloud computing, faced increased competition in 2024.

- Key competitors: Amazon Web Services (AWS) and Google Cloud remain significant competitors, constantly innovating and vying for market share.

- Strategies to maintain market share: Microsoft is investing heavily in its Azure cloud platform to stay competitive, enhancing features and expanding its global reach. However, maintaining market leadership requires continuous innovation and investment.

Meta's Struggles with the Metaverse

Meta's ambitious investment in the metaverse faced significant challenges.

- High costs associated with metaverse development: Building the metaverse requires substantial investments in hardware, software, and infrastructure, impacting profitability and straining resources.

- Lukewarm reception among consumers: The metaverse has yet to capture widespread consumer interest, raising questions about its long-term viability and market potential.

(Similar analyses could be applied to Nvidia's challenges in the semiconductor market, Amazon's struggles with its e-commerce and cloud businesses, and Tesla's challenges in the electric vehicle market. These would follow the same H3 structure above.)

Conclusion

The $2.5 trillion market value plunge of the Magnificent Seven in 2024 highlights the vulnerability of even the largest tech companies to macroeconomic forces and sector-specific challenges. Rising interest rates, inflation, geopolitical uncertainty, supply chain disruptions, increased regulatory scrutiny, and intense competition all contributed to this significant decline. Understanding these interconnected factors is crucial for navigating the complexities of the tech industry. The key takeaway is the interconnectedness of global economic factors and the vulnerability of even the most dominant companies. To stay updated on the ongoing challenges and future trajectory of the Magnificent Seven, continue following our insightful analyses and market reports. Understanding the intricacies of the Magnificent Seven's decline is crucial for investors and tech enthusiasts alike.

Featured Posts

-

U S Businesses Implement Cost Cutting Strategies In Face Of Tariff Volatility

Apr 29, 2025

U S Businesses Implement Cost Cutting Strategies In Face Of Tariff Volatility

Apr 29, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 29, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 29, 2025 -

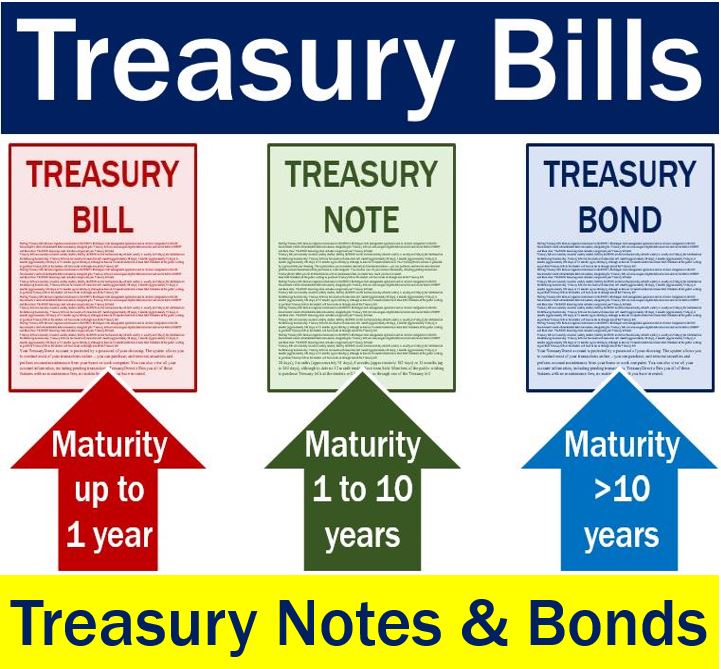

Understanding The Treasury Market Shift Insights From April 8th

Apr 29, 2025

Understanding The Treasury Market Shift Insights From April 8th

Apr 29, 2025 -

Hollywood At A Standstill The Combined Writers And Actors Strike

Apr 29, 2025

Hollywood At A Standstill The Combined Writers And Actors Strike

Apr 29, 2025 -

Alan Cummings Favorite Scottish Childhood Pastime Revealed By Cnn

Apr 29, 2025

Alan Cummings Favorite Scottish Childhood Pastime Revealed By Cnn

Apr 29, 2025

Latest Posts

-

Navigating The Difficulties Of All American Production

Apr 29, 2025

Navigating The Difficulties Of All American Production

Apr 29, 2025 -

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025 -

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025