Are Thames Water Executive Bonuses Fair? A Critical Examination

Table of Contents

Thames Water's Financial Performance and its Impact on Bonus Structures

H3: Profitability and Shareholder Returns: Thames Water's profitability significantly influences its executive bonus structures. While the company reports profits, a closer examination reveals complexities. Analyzing Thames Water's financial statements requires considering several factors:

- Year-over-year profit changes: Fluctuations in profit margins need to be contextualized against investment in infrastructure and operational costs. A consistent upward trend would support higher bonuses, while stagnant or declining profits would raise questions.

- Dividend payouts: The amount paid out to shareholders is a key indicator of financial health and influences the perception of fairness in executive bonuses. High dividend payouts alongside significant bonuses could spark public criticism.

- Return on Investment (ROI): A comparison of the return on investment relative to the industry average and the amount allocated to executive bonuses is crucial to assessing fairness. A low ROI coupled with substantial bonuses would likely be viewed negatively.

H3: Investment in Infrastructure and its Relation to Bonuses: Thames Water's aging infrastructure requires significant investment. The level of this investment is directly related to the justification for executive bonuses.

- Details on infrastructure spending: Data from Thames Water's annual reports and regulatory filings should transparently detail investment in infrastructure upgrades, maintenance, and leakage reduction programs.

- Comparison of infrastructure spending to bonus payouts: A critical analysis compares the proportion of revenue allocated to infrastructure improvements versus executive bonuses. A disproportionately high bonus payout compared to infrastructure investment would likely be seen as unfair by the public. For instance, if a significant portion of profits is directed towards bonuses while essential upgrades are delayed, it raises concerns.

Public Perception and the Social Responsibility of Thames Water

H3: Sewage Spills and Environmental Impact: The recent increase in sewage spills has severely damaged Thames Water's public image.

- Statistics on the frequency and severity of sewage spills: Quantifiable data on the number, duration, and environmental impact of sewage spills, readily available from the Environment Agency, is essential to understanding the scale of the problem.

- Public reaction and media coverage: Negative media coverage and public outcry directly impact the perception of the fairness of executive bonuses. The intensity of public criticism adds weight to the debate.

H3: Customer Service and Bill Increases: Rising water bills and poor customer service contribute to public anger.

- Examples of customer dissatisfaction: Reports from Ofwat (the water regulator), customer surveys, and social media sentiment analysis reveal the extent of customer dissatisfaction.

- Correlation between bill increases and executive compensation: A perceived disconnect between substantial bill increases and significant executive bonuses fuels public resentment. Transparency in demonstrating how bill increases directly relate to necessary infrastructure improvements is crucial.

Comparison with Similar Water Companies

H3: Benchmarking Executive Compensation: Comparing Thames Water's executive compensation packages with similar water companies is crucial to assessing fairness.

- Data on executive pay at similar companies: Benchmarking against UK and international water companies allows for a relative assessment of the competitiveness and fairness of Thames Water's compensation structure.

- Analysis of any significant differences and their potential reasons: Significant deviations from industry averages need explanation. Are there justifiable reasons for the differences, or do they point to excessive compensation?

H3: Industry Standards and Best Practices: Adherence to industry standards and best practices in executive compensation strengthens the legitimacy of Thames Water's approach.

- Examples of best practices in executive compensation: Best practices often incorporate performance-related pay linked to measurable Key Performance Indicators (KPIs), focusing on environmental performance, customer satisfaction, and investment in infrastructure.

- Assessment of Thames Water's practices against these standards: A critical assessment determines whether Thames Water's compensation scheme aligns with industry best practices and promotes responsible corporate behavior.

The Role of Regulation and Accountability

H3: Ofwat's Role and Oversight: Ofwat, the water industry regulator, plays a crucial role in overseeing Thames Water's performance and executive compensation.

- Ofwat's statements and actions regarding Thames Water's practices: Ofwat’s public statements, investigations, and any regulatory actions taken against Thames Water are relevant in assessing accountability.

- Effectiveness of Ofwat's regulatory mechanisms: An evaluation of Ofwat's effectiveness in regulating executive compensation and ensuring accountability is necessary.

H3: Government Intervention and Public Pressure: Government intervention and public pressure campaigns influence the debate surrounding Thames Water executive bonuses.

- Examples of government actions or public campaigns: Any parliamentary inquiries, government investigations, or public campaigns aimed at influencing Thames Water's practices should be considered.

- Their impact on Thames Water's policies: Assessing the impact of these interventions on Thames Water's policies and practices provides insight into the effectiveness of external pressure in promoting accountability.

Conclusion

The fairness of Thames Water executive bonuses is a complex issue with no easy answers. While the company reports profits and shareholder returns, its performance is marred by significant sewage spills, rising customer bills, and public dissatisfaction. Compared to industry benchmarks, Thames Water's executive compensation may appear excessive, particularly when considering the level of investment in infrastructure improvements. Ofwat's regulatory role and public pressure remain crucial in ensuring accountability and driving necessary changes. Ultimately, the current situation suggests a need for a more transparent and performance-based approach to executive compensation at Thames Water, strongly linking rewards to tangible improvements in environmental performance, customer service, and infrastructure investment.

Join the conversation: Is it time for a fundamental review of Thames Water executive bonuses and their relationship to company performance and public trust? [Link to Ofwat website] [Link to relevant petition/campaign]

Featured Posts

-

The Ftcs Appeal Will It Block The Microsoft Activision Deal

May 22, 2025

The Ftcs Appeal Will It Block The Microsoft Activision Deal

May 22, 2025 -

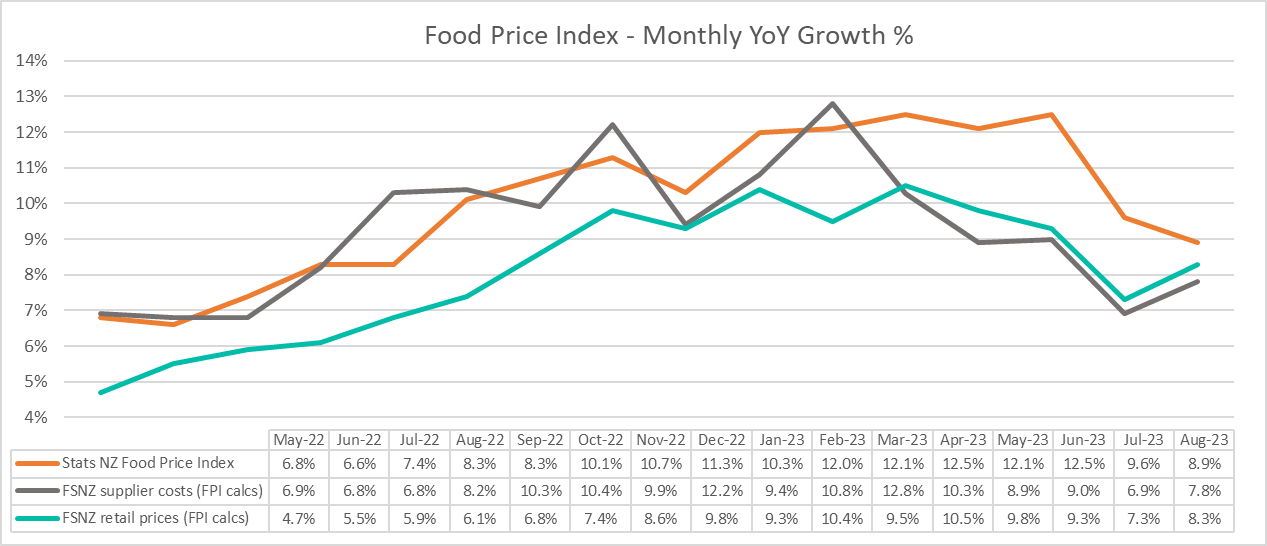

Grocery Bills Surge Inflationary Pressures On Food Costs Persist

May 22, 2025

Grocery Bills Surge Inflationary Pressures On Food Costs Persist

May 22, 2025 -

Nato Membership For Ukraine A Eurocommissioner Highlights Key Risks

May 22, 2025

Nato Membership For Ukraine A Eurocommissioner Highlights Key Risks

May 22, 2025 -

A Walking Journey Through Provence Mountains To Mediterranean

May 22, 2025

A Walking Journey Through Provence Mountains To Mediterranean

May 22, 2025 -

Call For Dialogue Switzerland And China Address Tariff Concerns

May 22, 2025

Call For Dialogue Switzerland And China Address Tariff Concerns

May 22, 2025

Latest Posts

-

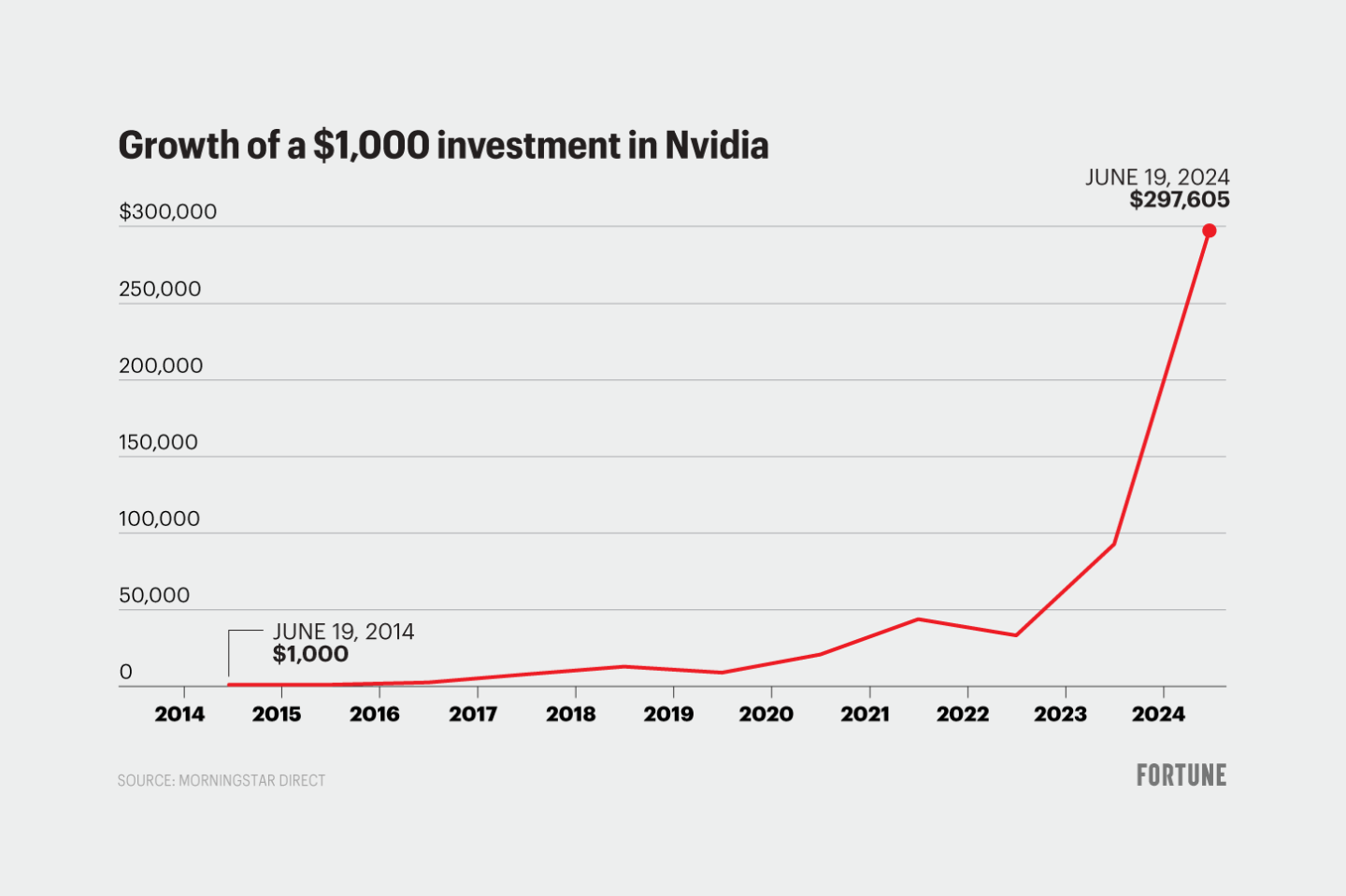

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

May 22, 2025

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

May 22, 2025 -

Core Weave Crwv Stock Price Increase Factors Contributing To Todays Movement

May 22, 2025

Core Weave Crwv Stock Price Increase Factors Contributing To Todays Movement

May 22, 2025 -

Understanding The Core Weave Crwv Stock Surge Analysis Of Todays Performance

May 22, 2025

Understanding The Core Weave Crwv Stock Surge Analysis Of Todays Performance

May 22, 2025 -

Core Weave Inc Crwv Stock Market Activity Explained Todays Gains

May 22, 2025

Core Weave Inc Crwv Stock Market Activity Explained Todays Gains

May 22, 2025 -

Why Did Core Weave Crwv Stock Price Rise Today

May 22, 2025

Why Did Core Weave Crwv Stock Price Rise Today

May 22, 2025