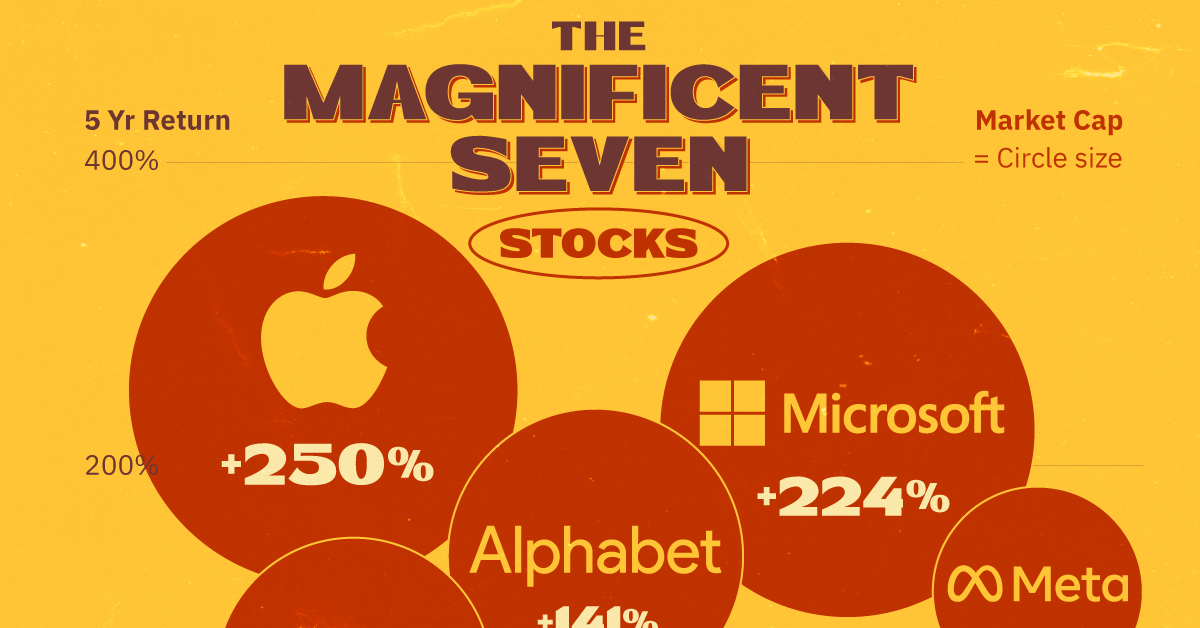

Magnificent Seven Stocks: A $2.5 Trillion Market Value Loss Analysis

Table of Contents

The "Magnificent Seven" refers to seven leading technology companies: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta (META), and Tesla (TSLA). These companies represent significant portions of the global technology market and hold considerable influence over the overall stock market's performance. Their combined market capitalization once represented a massive portion of global stock market value, making their recent downturn a major event for global finance. This article aims to analyze the contributing factors to this substantial loss and explore its implications for investors and the economy.

Macroeconomic Factors Contributing to the Decline

Several macroeconomic headwinds significantly contributed to the decline in the Magnificent Seven's market value.

Rising Interest Rates and Inflation

The Federal Reserve's aggressive interest rate hikes to combat persistent inflation played a crucial role. Higher interest rates increase the discount rate used to value future earnings, making growth stocks like those in the Magnificent Seven appear less attractive. This is because investors demand higher returns to compensate for the increased risk in a high-interest-rate environment.

- Example: Higher interest rates make it more expensive for companies to borrow money, hindering expansion and potentially reducing future earnings growth.

- Data Point: A correlation can be observed between the timing of interest rate increases and a downward trend in the stock prices of several Magnificent Seven companies. For instance, each rate hike announcement in 2022 was often followed by a period of significant decline in tech stock prices.

Recessionary Fears

Concerns about a potential recession further dampened investor sentiment. A recessionary environment typically leads to reduced consumer spending and corporate earnings, directly impacting the Magnificent Seven's revenue streams.

- Example: Reduced consumer discretionary spending affects Amazon's e-commerce sales and Alphabet's advertising revenue.

- Economic Indicator: The inversion of the yield curve, a strong predictor of recessions, added to the growing anxiety among investors.

Geopolitical Instability

Global events, such as the war in Ukraine and ongoing supply chain disruptions, added to the uncertainty. These factors increased input costs and hampered production, negatively affecting the tech sector's profitability and investor confidence.

- Example: The chip shortage, exacerbated by geopolitical tensions, impacted Nvidia's production of graphics processing units (GPUs).

- Data Point: Supply chain disruptions led to increased production costs and delivery delays, resulting in lower-than-expected revenue for several tech companies.

Company-Specific Challenges

Beyond macroeconomic factors, company-specific issues also contributed to the decline.

Overvaluation and Market Corrections

Prior to the downturn, some argued that the Magnificent Seven's stock valuations were inflated. The subsequent market correction essentially adjusted these valuations to levels considered more sustainable by investors.

- Valuation Metric: High Price-to-Earnings (P/E) ratios for several Magnificent Seven companies suggested potential overvaluation before the market correction.

- Market Correction: Market corrections are a natural part of the market cycle, often triggered by periods of overvaluation and speculation.

Competition and Shifting Market Dynamics

Increased competition and disruptive technologies challenged the Magnificent Seven's dominance in their respective markets, impacting market share and profitability.

- Example: The emergence of strong competitors in the cloud computing market puts pressure on Amazon Web Services (AWS) and Microsoft Azure.

- Market Share: Loss of market share directly translates to reduced revenue and potentially lower stock valuations.

Regulatory Scrutiny and Antitrust Concerns

Government regulations and antitrust investigations added to the pressure on these tech giants. Increased regulatory scrutiny can lead to increased compliance costs and limit growth opportunities.

- Example: Antitrust lawsuits against several Magnificent Seven companies could result in significant fines and changes to their business practices.

- Long-Term Implications: Increased regulatory pressure could fundamentally alter the business models of these tech giants and impact their future profitability.

Investor Sentiment and Market Volatility

A shift in investor sentiment and increased market volatility amplified the decline.

Shifting Investor Preferences

Investor preferences shifted away from growth stocks toward more defensive sectors, considered less susceptible to economic downturns. This resulted in significant capital outflows from tech stocks.

- Investor Flows: Data indicates a substantial shift in investor capital from growth stocks to sectors perceived as safer, such as utilities and consumer staples.

- Market Psychology: Media narratives and overall market sentiment played a crucial role in driving investor behavior and exacerbating the decline.

Increased Market Volatility

Increased market volatility magnified the impact of negative news, leading to more significant price swings in the Magnificent Seven's stocks.

- Market Fluctuations: Sharp market downturns significantly impacted the stock prices of these companies.

- Investor Behavior: Fear and uncertainty fueled investor sell-offs, accelerating the decline in market value.

Analyzing the $2.5 Trillion Loss in Magnificent Seven Stocks: A Look Ahead

The $2.5 trillion market value loss in the Magnificent Seven stocks resulted from a confluence of macroeconomic headwinds, company-specific challenges, and shifting investor sentiment. Rising interest rates, recessionary fears, geopolitical instability, overvaluation, increased competition, regulatory scrutiny, and shifting investor preferences all contributed to this significant decline. The implications are far-reaching, affecting not just the tech sector but the broader economy. The future outlook remains uncertain, with potential recovery scenarios balanced against ongoing risks.

While the short-term outlook may remain volatile, the long-term potential of these companies should not be discounted. However, investors must proceed with caution, carefully analyzing individual companies within the Magnificent Seven and understanding the evolving market landscape.

Call to Action: To navigate this dynamic market successfully, it's crucial to thoroughly understand the Magnificent Seven, analyze individual Magnificent Seven stocks, and develop a well-diversified investment strategy that mitigates risk. Invest wisely in the Magnificent Seven—but do so with informed decision-making and a comprehensive understanding of the current market conditions.

Featured Posts

-

Senate Leader Schumer Rejects Calls To Step Down I M Staying Put

Apr 29, 2025

Senate Leader Schumer Rejects Calls To Step Down I M Staying Put

Apr 29, 2025 -

Speedboat Stunt Goes Wrong Arizona Boating Competition Record Attempt Ends In Flip

Apr 29, 2025

Speedboat Stunt Goes Wrong Arizona Boating Competition Record Attempt Ends In Flip

Apr 29, 2025 -

Indian Equities Dsp Fund Managers Strategic Shift And Cash Allocation

Apr 29, 2025

Indian Equities Dsp Fund Managers Strategic Shift And Cash Allocation

Apr 29, 2025 -

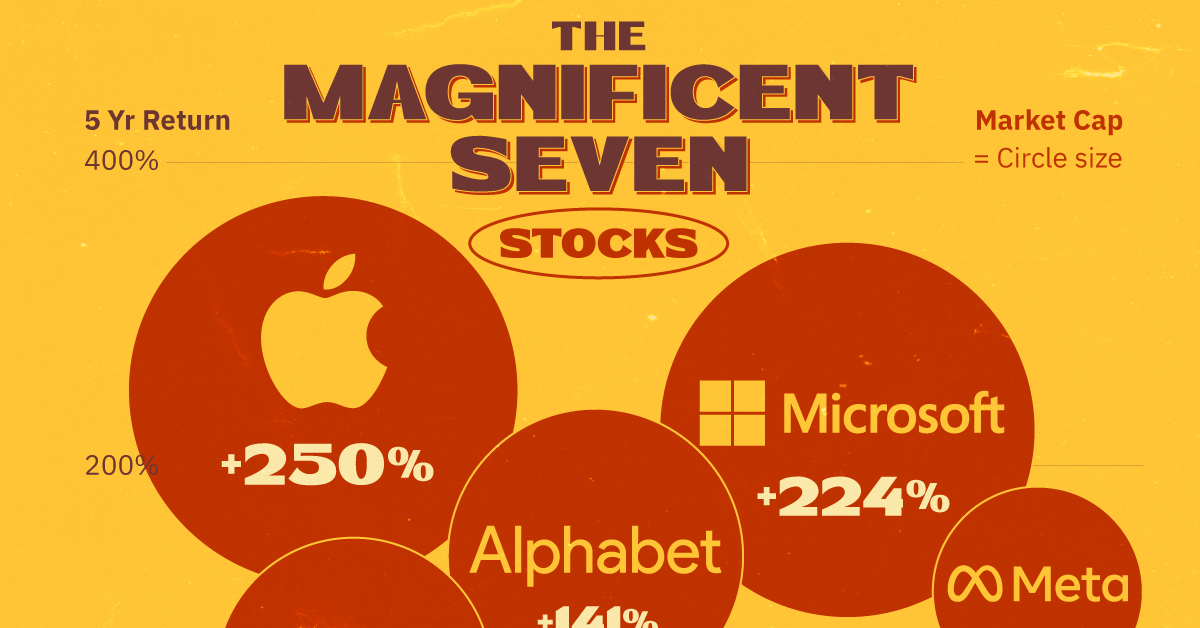

Venture Capital Secondary Market A Look At The Current Boom

Apr 29, 2025

Venture Capital Secondary Market A Look At The Current Boom

Apr 29, 2025 -

Understanding Ais Cognitive Limitations A Deep Dive Into Artificial Intelligence

Apr 29, 2025

Understanding Ais Cognitive Limitations A Deep Dive Into Artificial Intelligence

Apr 29, 2025

Latest Posts

-

Navigating The Difficulties Of All American Production

Apr 29, 2025

Navigating The Difficulties Of All American Production

Apr 29, 2025 -

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025 -

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025