Indian Equities: DSP Fund Manager's Strategic Shift And Cash Allocation

Table of Contents

DSP's Rationale Behind Increased Cash Allocation in Indian Equities

DSP's decision to increase its cash allocation in Indian equities stems from a confluence of factors pointing towards a need for caution and strategic positioning within the market.

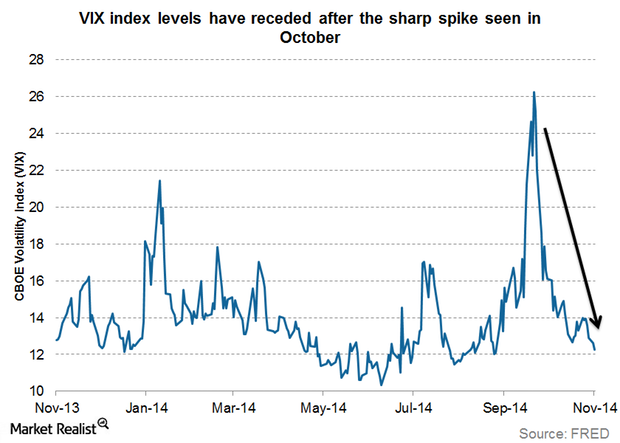

Market Volatility and Uncertainty

The Indian equity market, like many global markets, has experienced considerable volatility recently. This uncertainty is fueled by a range of global and domestic factors.

- Rising inflation: Persistent inflationary pressures globally are impacting consumer spending and corporate profitability, creating uncertainty in the market.

- Geopolitical risks: Geopolitical tensions, particularly the ongoing conflict in Ukraine, contribute to market instability and influence investor sentiment negatively.

- Interest rate hikes: Central banks worldwide, including the Reserve Bank of India, are raising interest rates to combat inflation. This impacts borrowing costs for businesses and can slow economic growth, impacting equity valuations.

These factors have created a climate of uncertainty, prompting DSP to adopt a more cautious approach to investing in Indian equities.

Valuation Concerns in Certain Sectors

DSP's increased cash allocation also reflects concerns about valuations in specific sectors of the Indian equity market.

- Overpriced technology stocks: The technology sector, while promising, has seen significant price appreciation in recent years, leading to concerns about overvaluation in certain segments.

- High valuations in specific consumer goods segments: Similar concerns exist in some consumer goods segments, where valuations may not fully reflect underlying fundamentals.

DSP's reduced exposure in these sectors reflects a strategic decision to avoid potentially overvalued assets and preserve capital.

Seeking Attractive Entry Points

A core component of DSP's strategy is to wait for more attractive entry points in the market.

- Identifying undervalued stocks: By holding a higher cash position, DSP is positioning itself to capitalize on potential market corrections and identify undervalued stocks.

- Capital preservation: Maintaining a significant cash reserve is a conservative approach prioritizing capital preservation during times of uncertainty.

- Strategic investment opportunities: This strategy allows for selective investments in fundamentally strong companies trading at discounted prices during market downturns.

Impact of the Strategic Shift on Indian Equities

DSP's strategic shift has significant implications for the broader Indian equity market.

Potential Effects on Market Sentiment

DSP's actions could influence market sentiment, potentially causing a ripple effect amongst other fund managers.

- Investor behavior: Other investors may follow suit, leading to decreased buying pressure and potential market corrections.

- Market trends: The shift could contribute to a period of market consolidation or a temporary downturn.

- Overall market performance: The short-term impact on market performance could be negative, but a strategic repositioning could benefit long-term stability.

Opportunities for Selective Investment

While DSP's shift might seem negative, it also creates opportunities for discerning investors.

- Undervalued stocks: Market corrections often lead to undervaluation of fundamentally strong companies.

- Emerging sectors: Sectors less susceptible to global volatility might emerge as attractive investment options.

- Growth potential: The potential for higher returns exists by strategically investing in undervalued sectors during market corrections.

Long-Term Implications for Indian Equity Market Growth

The long-term implications of this strategic shift are complex and depend on various factors.

- Long-term investment strategies: This might be a temporary adjustment, or it could reflect a longer-term shift in investment strategies for Indian equities.

- Sustainable growth: Market corrections are often necessary for sustainable long-term growth.

- Market stability: This shift could potentially lead to increased market stability over the long run.

Alternative Investment Strategies for Indian Equities

Given DSP's shift, investors may consider alternative strategies to mitigate risk and diversify their portfolios.

- Debt instruments: Debt instruments offer lower risk compared to equities, providing stability during market volatility.

- Gold: Gold is a traditional safe-haven asset that can act as a hedge against inflation and market uncertainty.

- Real Estate: Real estate investments can offer diversification benefits and potential long-term growth, though liquidity can be a factor.

Conclusion: Navigating the Indian Equity Market with Informed Decisions

DSP's increased cash allocation in Indian equities reflects a cautious approach to navigating current market uncertainties. Understanding this strategic shift, along with its potential impact on market sentiment and investment opportunities, is crucial for investors. Remember, market volatility is inherent to the investment landscape, and informed decision-making is paramount. Stay informed about the evolving landscape of Indian Equities and make well-informed decisions based on your risk tolerance and investment goals. Understanding fund manager strategies, like DSP's shift in cash allocation, is crucial for navigating this dynamic market. Consult with a financial advisor for personalized guidance tailored to your specific circumstances.

Featured Posts

-

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025 -

5 Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 29, 2025

5 Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 29, 2025 -

100 Immigrants Detained In Underground Nightclub Raid Cnn Video

Apr 29, 2025

100 Immigrants Detained In Underground Nightclub Raid Cnn Video

Apr 29, 2025 -

Bof A Reassures Investors Why Stretched Stock Market Valuations Arent A Threat

Apr 29, 2025

Bof A Reassures Investors Why Stretched Stock Market Valuations Arent A Threat

Apr 29, 2025 -

Magnificent Sevens Market Cap Meltdown 2 5 Trillion Lost This Year

Apr 29, 2025

Magnificent Sevens Market Cap Meltdown 2 5 Trillion Lost This Year

Apr 29, 2025

Latest Posts

-

Navigating The Difficulties Of All American Production

Apr 29, 2025

Navigating The Difficulties Of All American Production

Apr 29, 2025 -

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025 -

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025